Welcome to Sports Cards Insider – FREE Version.

We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

Today is a deep dive into two assets:

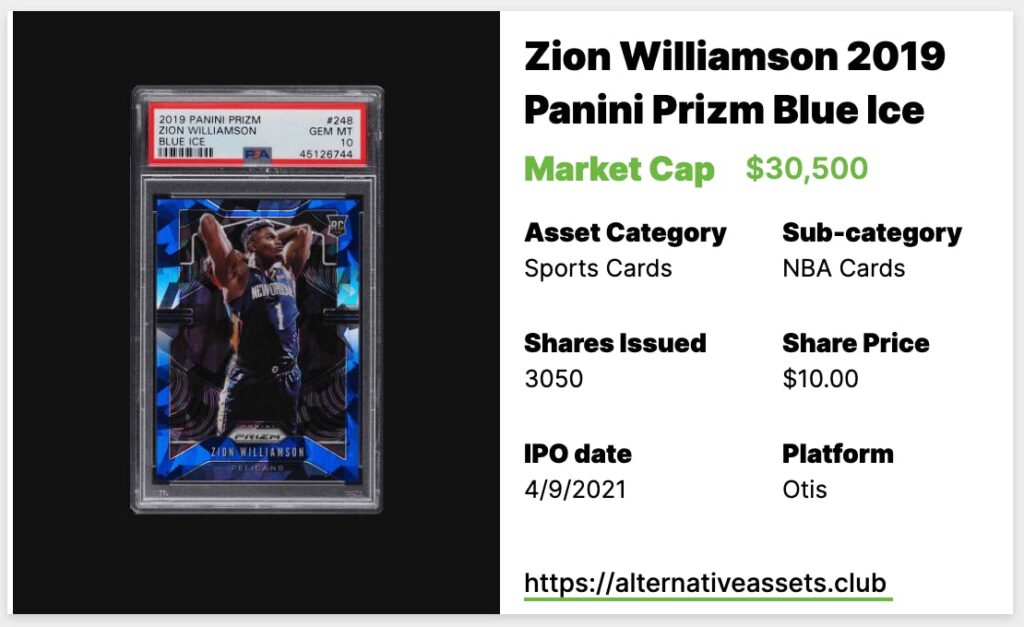

- Zion Williamson 2019 Panini Prizm Blue Ice #248 /99 PSA 10 – IPOs 9th April on Otis

- Magic Johnson Larry Bird 2004 – 2005 Logoman /1 BGS 9 – IPOs 11th April on Collectable

Table of Contents

What is the Zion Williamson 2019 Panini Prizm Blue Ice #248 /99 PSA 10?

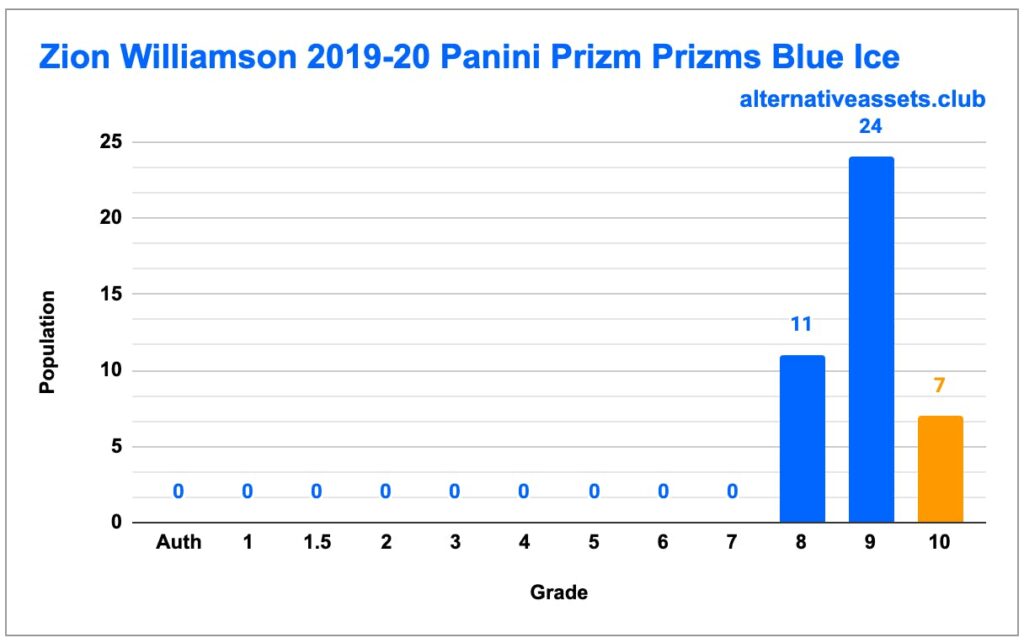

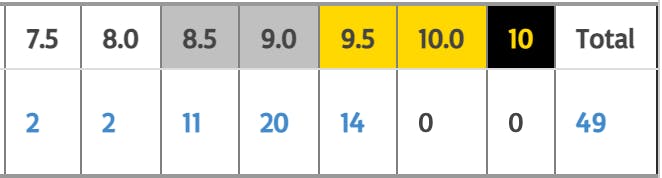

This is a limited run /99 Zion Williamson rookie card from the 2019 Panini Prizm set. Blue Ice is one of 40 different parallels and refractor cards from the set. I’ve not summed up all the cards registered with BGS and PSA, but there are somewhere between 10k and 20k of these limited run cards. Of the 42 at PSA, seven have been graded PSA 10.

For reference here’s the breakdown of cards at BGS.

It IPOs on Otis 9th April with no retained equity.

Add IPO to calendar

Cultural Relevance

Selected as the first overall pick by the New Orleans Pelicans in the 2019 NBA draft, Williamson was named to the NBA All-Rookie First Team in 2020. During his rookie campaign, he became the first teenager (yes, he was born in 2000) to score twenty points in ten consecutive games.

He also became the first rookie since Michael Jordan to post sixteen twenty-point games within his first twenty games. Slightly obscure stat, that.

In February 2021 he became the youngest player in NBA history with 30 points on 90% shooting.

He was selected as an All-Star in 2021.

In 2019, Williamson signed a five-year $75m shoe deal with Nike (despite the injury), which was the second-highest rookie shoe deal ever after LeBron James.

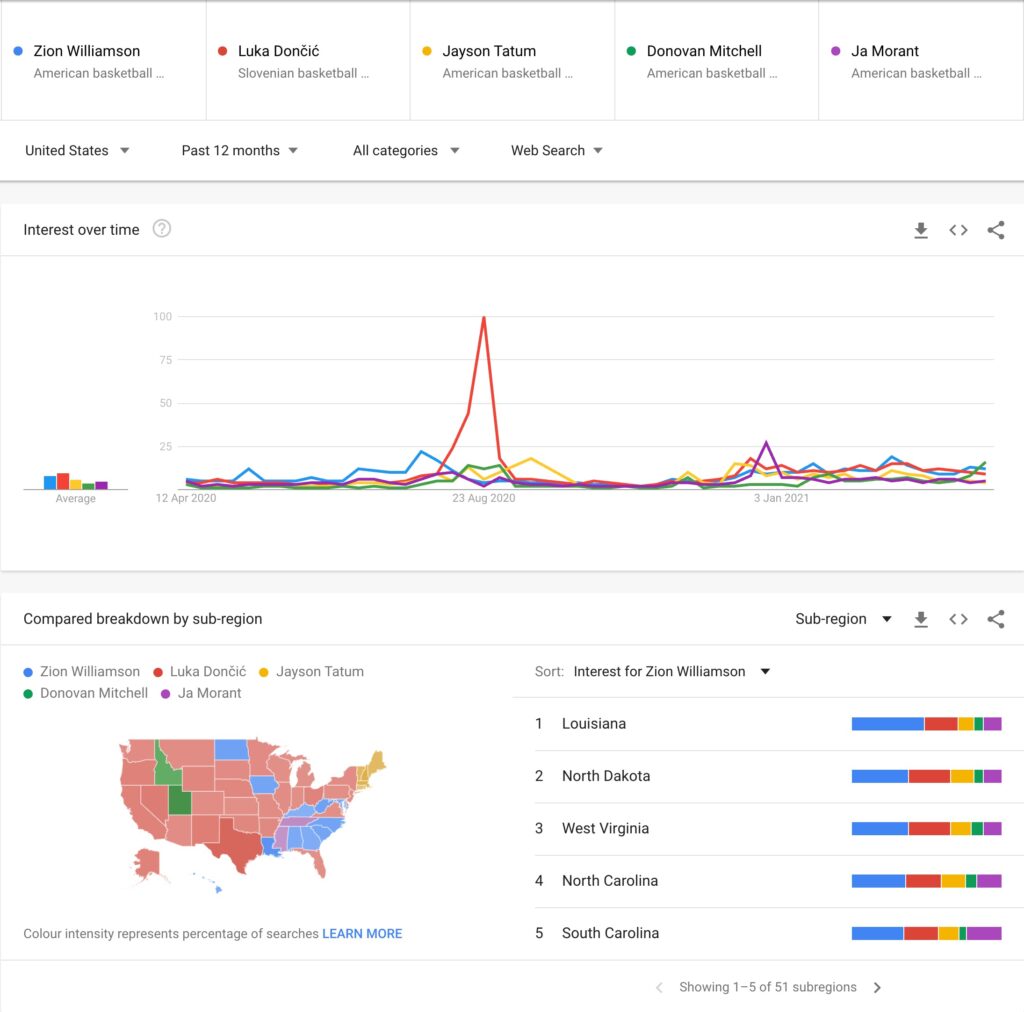

Relative to other young NBA stars, he’s just slightly second-tier behind Luka Dončić, though it’s worth noting Dončić has been around a bit longer and plays for a better team.

Inferred Value – $15k to $30k

[Detailed valuation available to Insiders]

Category Strength

The sports cards category returned a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

This is a bet that Williamson will emerge as a generational player the likes of Jordan, Erving, Bird, LeBron, etc.

Asset Liquidity

This will have a roughly 30 day lockup period then will trade daily.

Platform Risk

Intangibles

During a Duke game, Zion Williamson’s foot ripped through his Nike shoe, causing him to slip and injure himself. Nike’s stock lost $1.1B in market value the next day.

On a slightly more serious note, the scarcity argument is a bit of a missell when there are perhaps 20k rare cards out there.

Points 3/10

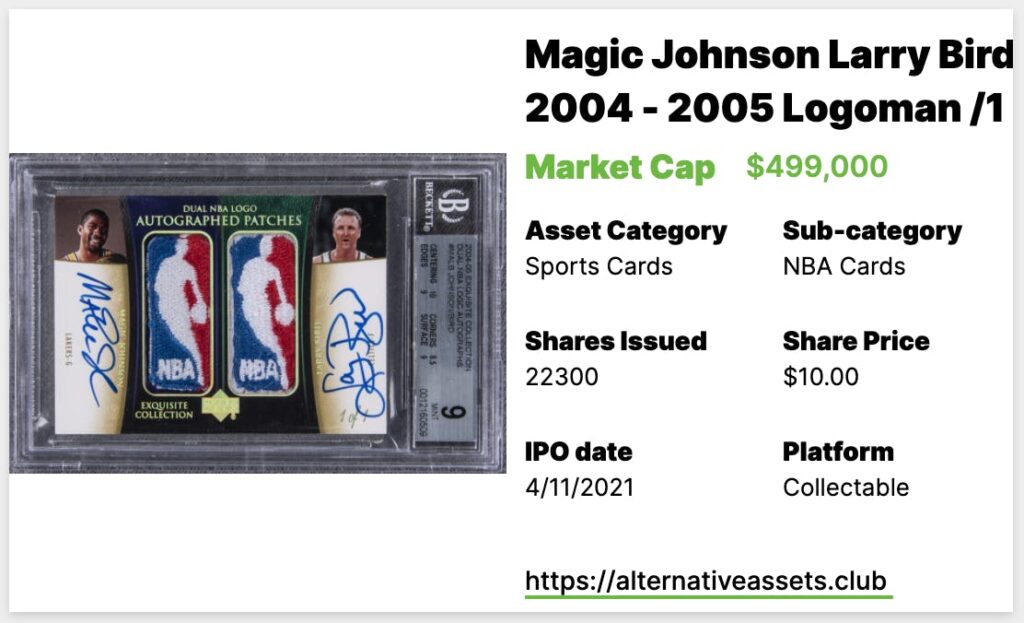

What is the Magic Johnson Larry Bird 2004 – 2005 Logoman /1 BGS 9?

This is a 1/1 card featuring 1980s greats Magic Johnson and Larry Bird. Because it’s 1/1, grade doesn’t really matter, but it’s a BGS 9 fwiw.

The card itself features NBA logos cut from their jerseys (that’s Jerry West, by the way) and autographs from each player.

It IPOs on Collectable at 6pm EST 11th April for $499k and will have $276k retained equity (55%)

Add IPO to calendar

Cultural Relevance

There have been several Bird / Magic items IPO’ed lately. You can read about the men, and their rivalry, here and here.

Inferred Value – < $500k

[Detailed valuation available to Insiders]

Category Strength

The sports cards category returned a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

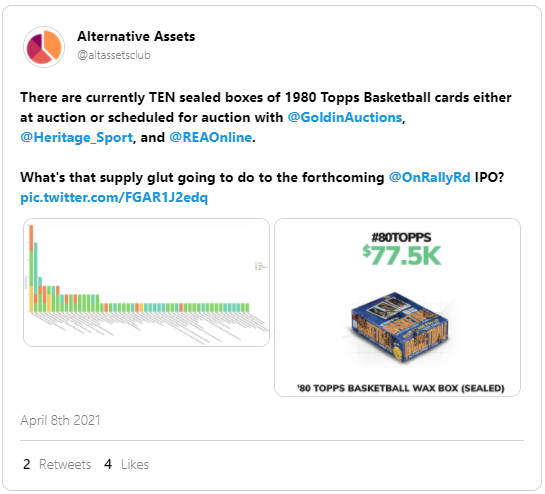

Yesterday on Twitter, we did a thread on the 1980 Topps Basketball set and the card that props it up — the Bird / Magic rookie mentioned above.

There’s a supply glut coming, and that’s alongside an already weak market for their rookie card and box.

There’s a decent chance their rookie could lose another 25% in the next few months.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade daily.

Platform Risk

Intangibles

It’s a 1/1 card, which is very cool.

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and run Flippa’s Due Diligence program, and can offer the same service to you.

Enquire about Due Diligence Packages

Subscription Options

Start your free trial of Insider.

Deep research and investment insights, now on thirteen alternative asset classes.