Prices are up. A look at why, and what this means for the industry.

Welcome to issue #4 of Alternative Assets by Stefan von Imhof. Each week I explore unique investment ideas, with a big focus on digital assets.

I hope you enjoyed last week’s Why the website investing space isn’t bigger. This week’s topic is about digital asset inflation. Let’s get right into it!

Table of Contents

The Fed’s Role

This week, it was revealed the US Federal Reserve is likely to pursue an agenda of higher inflation, meaning our record-low interest rates would likely not increase for many years. This could be announced as early as September.

This is fascinating for a number of reasons. One of the biggest unsolved mysteries of our time is why inflation isn’t higher. Inflation is an increase in the money supply that exceeds the increase in real output. The Fed has pumped trillions of dollars into the economy, yet inflation isn’t really budging. It goes against everything we thought we knew about how inflation works (which as it turns out, may not be much after all.)

One theory is that technology itself is hugely deflationary. Many are starting to argue that Amazon alone is actually keeping inflation down. If true, it stands to reason that we can actually print as much money as we want as long as inflation remains controlled. (This is Modern Monetary Theory in action, and could very well lead to future social welfare/stability programs like Universal Basic Income.)

Another theory is that we do indeed have inflation – it just manifests itself differently. Instead of showing up in the price of everyday consumer goods, it shows up in skyrocketing real estate, stocks, venture/growth capital, bitcoin, artwork, classic cars, wine, and other assets.

I think I subscribe to a mix of these two theories. Scarcity of goods may be decreasing, but scarcity of vehicles that produce returns is alive and well. With savings/interest rates starting to go negative, the extra money simply has nowhere else to go!

Put another way – in humanity’s endless hunt for anything that smells remotely like yield, there is far more money chasing a relatively limited number of rent-seeking/yield-producing assets.

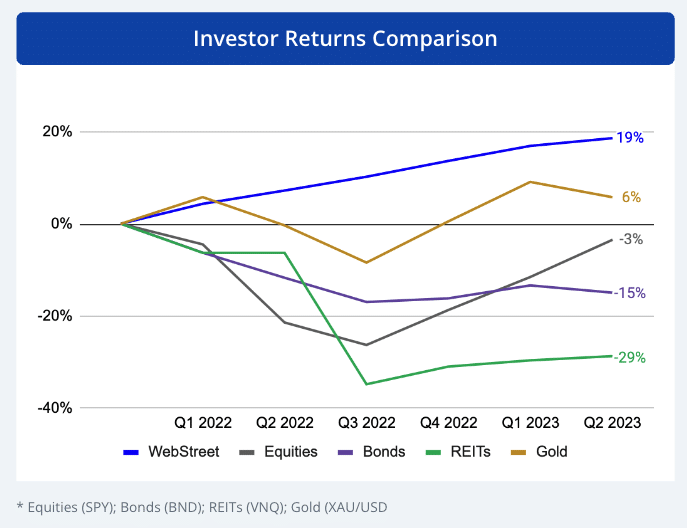

And one of the places all this extra cash ends up is, well, digital assets. Every other asset class is inflating. Why would digital assets be any different?

Digital Asset Multiples Over Time

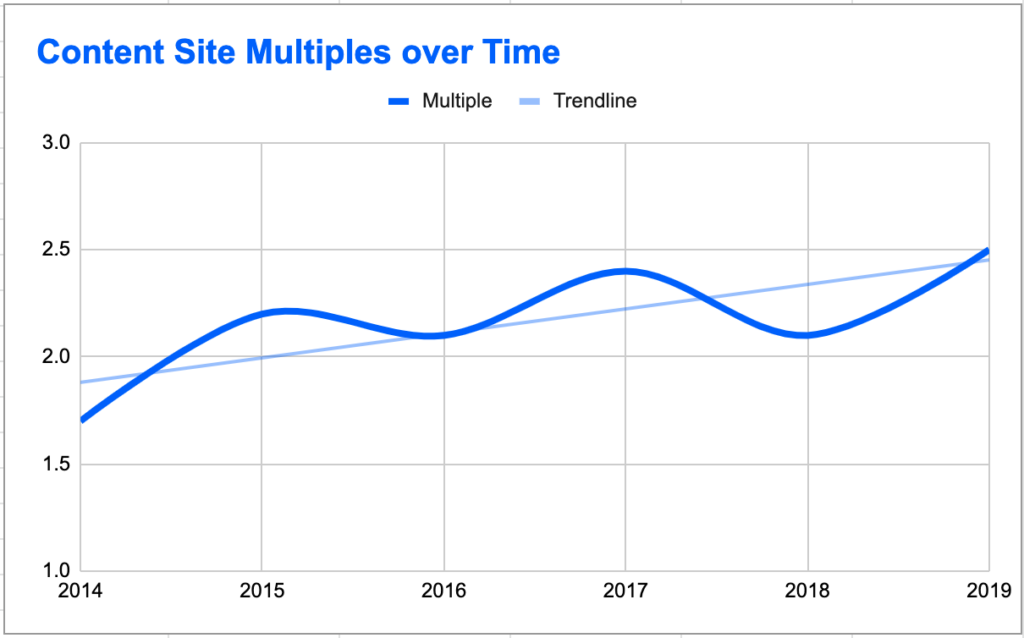

While I sold my first website back in 2012, I can’t say I really got into the website investing space until somewhat recently. Spending time in this space, you often hear tales of “the glory days” of the mid-2010s, when you could buy a content site for under 2x annual net profit.

Those days are indeed mostly over. While there are still plenty of good deals under 2x (use Flippa’s new multiple search filter to quickly find ‘em), according to Empire Flippers 2020 State of the Industry report, last year’s average multiple was around 2.3x, which is up 8% from the prior year.

I did some digging of my own through Flippa’s historical sales data to see what I could find. I looked specifically at established content sites at least 1 year old, with at least 300 pageviews/month, net profit of at least $100 per month, and a sale price of at least $2,500.

I went back 7 years. Here’s what I found:

The trend is clear: multiples have definitely gone up over time.

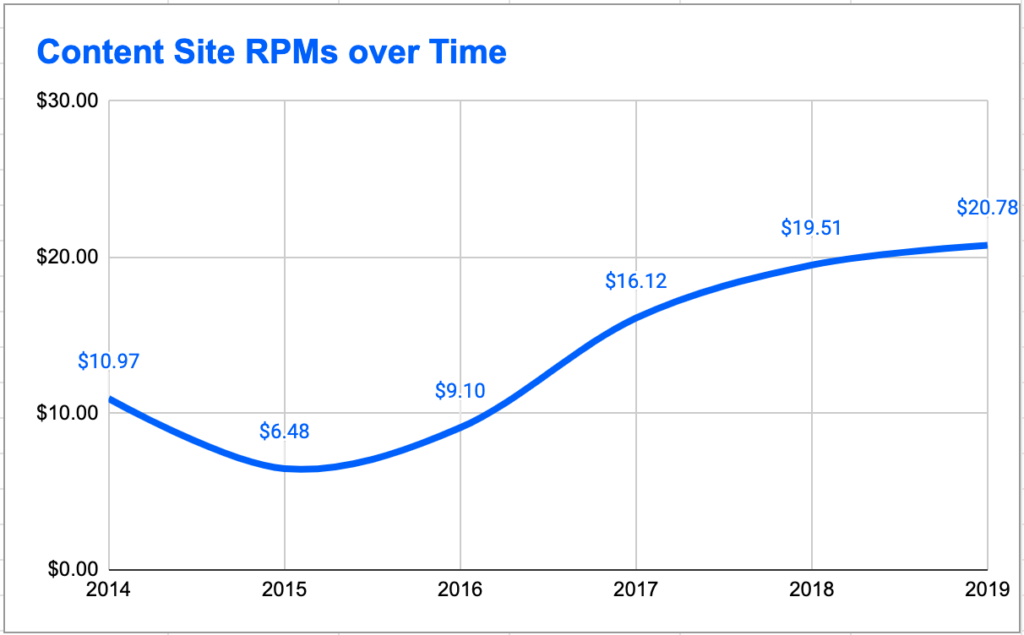

To kick it up a notch, I also looked at the median RPMs over time. What I found was even more interesting…

…Yup! RPMs are going up as well.

This brings us to another factor that might be at play here.

Another Factor Driving Inflation

One of the lesser-discussed factors driving digital asset inflation is the fact that ad tech has simply gotten a lot better over the past 6 years.

Back in 2014, AdSense was the most popular way to monetize content sites. There were other options that gave higher RPMs, but they weren’t as widely adopted. As Ezoic, Mediavine, and other digital publishers have gotten more popular over the years, they have pushed up RPMs (and thus yields + exit multiples) along with them.

What The Future Holds

Given the clear rise in digital asset prices, there’s a lot of speculation about whether multiples will start to come down. With increasingly unpredictable Google core updates and Amazon hell-bent on driving their affiliate program to zero, some folks think we are due for a contraction of content site multiples.

I don’t see it that way.

I think we may see some ebb and flow in certain areas as things shake out post-COVID. But at the end of the day, I don’t think a broad-based contraction is in the cards at all.

If anything, I think the opposite is bound to happen. We are more likely to see prices continue to rise as awareness around the space gets bigger, as the speed of information continues to accelerate, and hungry funds start to play ball.

For buyers, this means your purchases will get more expensive. Good deals will become tougher to find, and you will be competing against not only a thousand new Flippa registrants per day, but an army of well-funded buyers that are smarter, have access to better data, and move very quickly.

But there are two sides to this coin. For sellers, your exits will be higher as well. Especially if you hang on for longer. So it all likely evens out.

And between the fantastic returns, the satisfaction of owning an asset that both appreciates in value and spits out cash, and the ability to influence your returns and outperform the market, I still think investing in digital real estate is one of the best deals in town.

If you ask me, the glory days are absolutely still here. Five years from now we’ll look back in amazement that you could buy a quality content site in 2020 for just 2.3x. ?

New Alternative Assets Website

Today I spun up a new website for this project: AlternativeAssets.club

Why create a website when I already have a Substack? A few reasons. First, it’s an additional acquisition channel. An easy way to get some incremental traffic for this project while having more control over how it unfolds.

But there’s an even better reason to have a standalone website. If all my content lives on Substack, I don’t actually gain anything from it.

I ultimately want to ensure all my content lives on a site that I own. The goal is to use Substack as a blogging/publishing platform, while using my website to rank for long-tail keywords. The hope is that eventually over time, I can monetize the site itself along with the newsletter.

But won’t Google penalize your site for duplicative content?

Not if you play your cards right. What you can do is use your Substack posts as a “feeder” to your core website, where the bulk of your content actually lives permanently.

I put together a quick guide to help all the frustrated Medium writers who are looking to actually monetize their blogs. The same process can be applied to Substack as well. Pretty cool!

Fun Medium hack:

— ?? Stefan von Imhof (@stefanvonimhof) July 18, 2020

People are starting to realize publishing on Medium earns you nothing, which is partly why Substack is flourishing.

But if you’ve created content on Medium and are frustrated that you’re getting nothing for it, here’s a quick monetization idea that works:

Oh, and if you’re wondering, yes AlternativeAssets.com was already taken. But I could care less about that. Also, the .club TLD is quickly rising in popularity. Just ask these guys.

Other News

- FounderPath launched on ProductHunt this week to solid reviews. In the spirit of calling everything a “service”, they refer to what they do as “capital as a service.” But it’s more like a revenue-based financing alternative to VC for micro SaaS founders. Investors basically loan money to FounderPath at 12%, and FounderPath lends it right back to qualified SaaS founders at 15%, pocketing the difference. My guess is they utililze software from an API verification company such as Glew or Tray to assess the actuarial risk. I look forward to learning more about this company and diving into the potential investment opportunities here.

- Ratesetter has rebranded as Plenti. Plenti is an Australian P2P lending platform which offers solid rates on 3-5 year loans. Their flagship offering is a Renewable Energy loan that yields at least a 6% return. You’re basically lending to well-off Australian homeowners who are installing solar panels – a pretty safe bet. But to stay on the safe side, Plenti has a $17.3 million dollar provision fund which protects you in the event your loan defaults. I really like this company’s approach, and will cover them in detail in a future issue.

That’s it for this issue! I’m now four issues in, and I must say I love writing this newsletter so far. If you enjoy reading it, please share it with a friend!

Thank you for your support. It means a lot to me and helps keep this party going.

See you next week!

How’d you like this issue?