Welcome to the latest issue of Video Games Insider – FREE Edition.

Today we’re doing something new – a brief write-up and update on an asset that is currently trading. In this case, the copy of Super Mario Bros that will be trading on Rally Road May 14th, 2021 from 9:30 AM – 4 PM EST and the copy that is currently trading on Otis every day, with a clearing time of 2 PM EST.

Follow me on Twitter for my latest insights and analysis.

Table of Contents

What are the Assets?

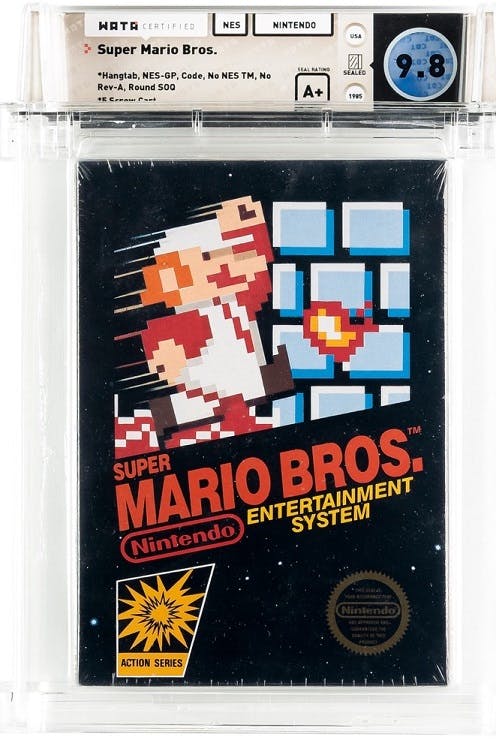

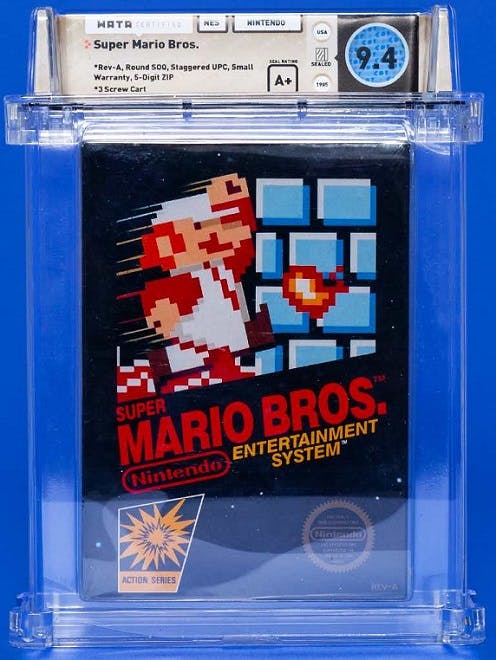

The Rally Road asset is a sealed copy of the original Super Mario Bros. game for NES, graded 9.8 A+ by WATA and is a #5 variation of the game. The Otis asset is a similar sealed copy of the original Super Mario Bros. game for NES, graded 9.4 A+ by WATA and is a #8 variation of the game.

There were many different variations of the game released and it’s crucially important to know which variation each copy is. Earlier variations are more valuable than later ones. This guide is a really good breakdown of the differences and can help identify the variations. The two major distinctions seem to be hangtab v. no hangtab and Round SOQ v. Oval SOQ. The hangtab is present up until variant #6, and the Round SOQ is present up until variant #8. The most valuable copies have both, and the hangtab is more important, but there has been a pretty steep drop-off after variant #8 for the copies that have neither.

As a reminder – go read about the WATA scale if you haven’t yet. The grade is the main driver of a video game’s value and understanding its meaning is crucial. The first number represents the condition of the item (in this case, the unopened box) on a 10-point scale, with increments of .5 until 9, and then increments of .2 until 10.

The second part of the grade is the seal grade – the condition of the factory seal. This scale goes from C to A++.

What are the current status of the Assets?

The 9.8 A+ at Rally Road originally IPO’d at $50/share with a value of $150,000, but ended last trading window at a price of $100/share, which values the asset at $300,000. Importantly, there was a buyout offer received on April 30th for $585,000 with a net value of $485,505 or $161.50/share. The offer was soundly rejected by Rally shareholders (I voted no). I would expect the trading price to rise to that level or higher, but the secondary markets are often illogical. The 9.4 A+ at Otis originally IPO’d at $10/share with a value of $77,600. It reached a high of $23/share but its current price is $16.01/share, which values the asset at $124,237.60. Importantly, the lowest current asks are at $19.64/share, which values the asset at $152,406.40, which we’ll call the current price, because that’s what you can buy it at right now.

Category Strength

The Video Game Cartridges category posted a 59% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Inferred Valuation / Target Share Price

[Detailed Valuation for Insiders Only]

Asset Growth TTM

Growth Outlook and Future Catalysts

This is the asset to own in the video game market. And I expect any high graded copies to continue to set records and get media coverage for doing so in the future. Rally’s copy is the more likely of the two to go parabolic given its high grade. There is an auction for a #7 variation graded 9.0 A next month at Heritage. It’s not a close enough comparable to be definitive but it will be an important data point, especially for the Otis copy.

Final Thoughts

We know the floor for the Rally copy (the recent buyout offer). I’d expect both assets to hold long-term value as they are the most blue-chip offerings in the entire video game category. Do be aware of the double taxation issue for the buyouts and the thin, irrational trading market at Otis.

Disclosure: I own shares of both assets on both sites.