Welcome to the latest issue of Trading Updates / Video Games Insider. This is a new feature so you’re getting the paid version even though you’re a free subscriber. From next week, you’ll receive the FREE version, which won’t have as much analysis or information. You can get a one week trial to Insider with no cost or obligation.

This is part of a new feature – a deep dive into one asset that is trading this week. In this case, the copy of The Legend of Zelda: Ocarina of Time that will be trading on Rally Road May 20th, 2021 from 9:30 AM – 4 PM EST. Follow me on Twitter for my latest insights and analysis. Starting soon, the ONLY WAY to receive all trading updates is by subscribing to the Trading Update topic by clicking below:

You can view all assets trading this week here.

Table of Contents

What is the Asset?

This is a sealed copy of the 1998 N64 game The Legend of Zelda: Ocarina of Time graded 9.6 A+ by WATA. Note that is the Collector’s Edition of the game, which was only available as a pre-order. Rally originally purchased it last December for $20,000.

The first Legend of Zelda game released for the N64, Ocarina of Time was a massive critical and commercial success, selling the most copies of any video game released in 1998. Overall, it’s the 4th highest selling N64 game of all-time and is generally considered to be one of the greatest video games ever made. The Legend of Zelda series of games are among the best-known and most popular in the world.

If you are new to Video Games, go read about the WATA scale. The grade is the main driver of a video game’s value and understanding its meaning is crucial. The first number represents the condition of the item (in this case, the unopened box) on a 10-point scale, with increments of .5 until 9, and then increments of .2 until 10, though in practice they don’t give out 10s.

The second part of the grade is the seal grade – the condition of the factory seal. This scale goes from C to A++.

What is the current status of the Asset?

This originally IPO’d on February 4th with 5000 shares at $4.70 each for a total valuation of $23,500. The IPO sold out quickly and this is the first trading window.

Category Strength

The Video Game Cartridges category posted a 59% ROI in Q1 2021.

Risk Profile

Standard deviation for all Video Game Cartridges transactions has been 179%, which is very high.

Inferred Valuation / Target Share Price

- Target Share Price: $4.60/share (currently $4.70/share)

Valuation details:

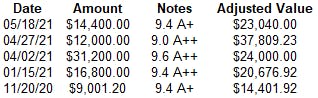

There was just a sale this week at Heritage of a copy graded 9.4 A+ that went for $14,400. Applying a 60% premium for the grade jump to 9.6 gets just over $23K, right around the IPO price. Looking at the most recent sales this seems right in line (the 9.0 A++ sale looks like a pretty substantial outlier at the moment):

As mentioned above, Rally bought their copy for $20,000 in February, which is consistent with the valuation. Because there’s such a recent sale that falls in line with expectations, we can stick with $23,000 as the current value.

Past Asset Growth

There’s been about a 60% appreciation since the sale last November.

Growth Outlook and Future Catalysts

A “new” Legend of Zelda game is going to be released this July for the Nintendo Switch — it’s an HD remaster of The Legend of Zelda: Skyward Sword originally released for the Wii. The pre-orders for the game on Amazon sold out. If the game is a massive success and becomes newsworthy, the value of Ocarina of Time and others in the series would benefit.

Final Thoughts

As is stands, the asset is worth right around the IPO price. However, the secondary market on Rally has been cratering recently and a lot of assets are dropping significantly in their first trading window. If that happens here, I’d be ready to pounce. Check the clearing price and your bids before 4 PM so you don’t miss out when it clears. If you are not subscribed to the Video Games category and want to be, click below:Add Video Games Topic