Welcome to the Fractional Trading & Index Update.

This is one tight email with all the analysis and insight you need to make informed decision on the fractional secondary markets:

- The Fractional Trading Index

- Fractional Trading Insider

Table of Contents

What is the Fractional Investment Index?

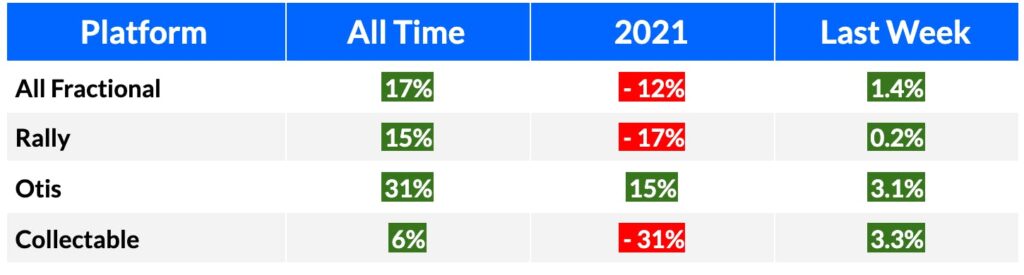

This is the world’s first index that tracks the performance of all IPOs across Rally, Collectable, and Otis since inception, and gives individual results for each platform.

And it’s exclusive to Alternative Assets subscribers.

Fractional Performance Index for July 26th 2021

Alternative Assets Club Performance

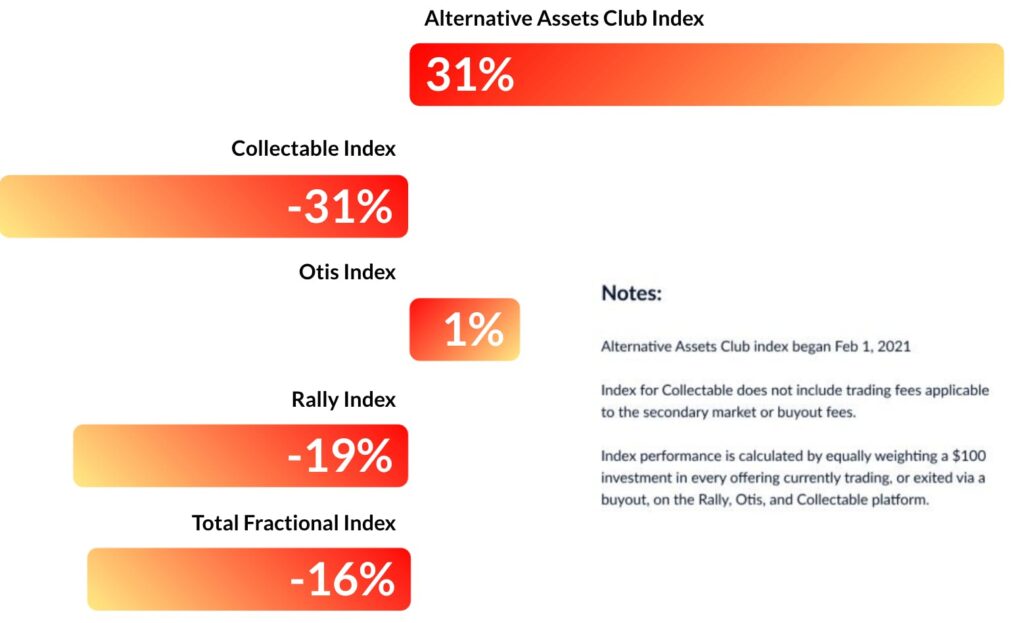

With Insider, you know we analyze every fractional IPO, giving each one a Yes or No recommendation.

Based on those recommendations, we’ve also launched the Alternative Assets Index.

Since February 1st 2021, we’re beating the Index by 50 points.

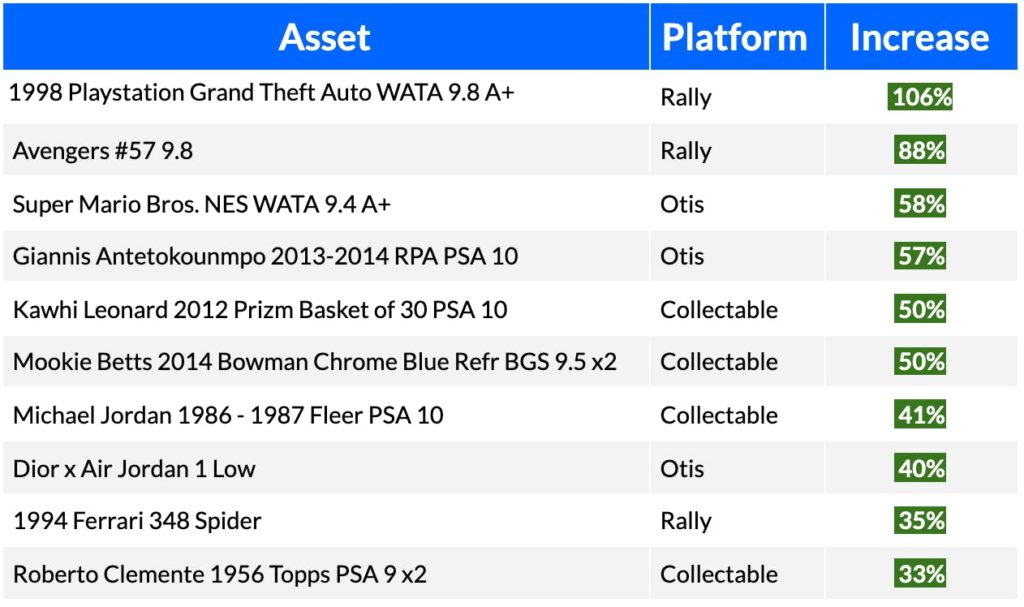

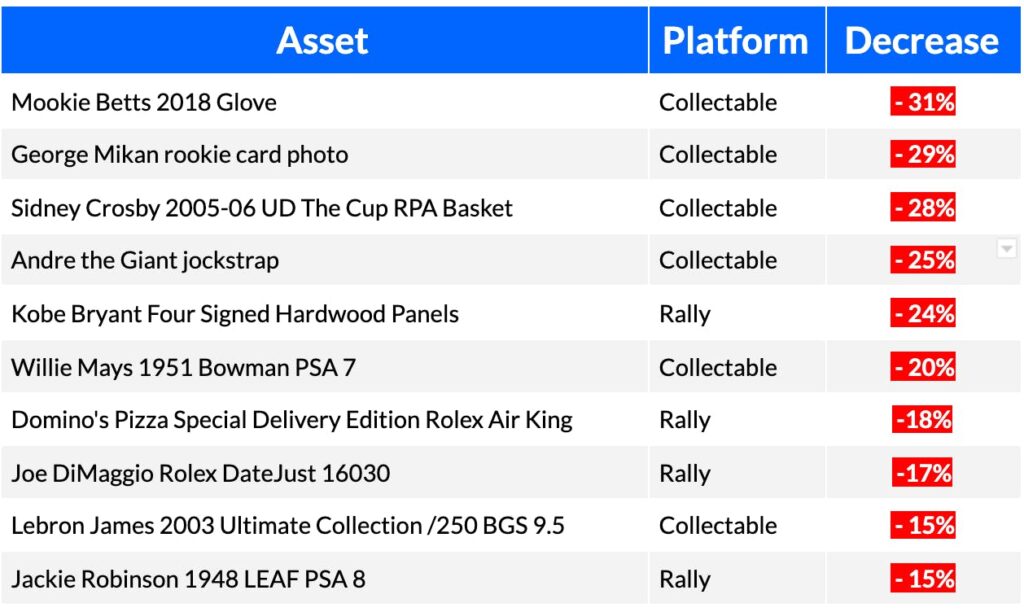

Weekly Winners and Losers

What’s trading this week?

Note: Otis is reintroducing assets as they roll out live trading. We believe they’re taking this week’s batch live on Wednesday, but that’s not confirmed.

Assets we think are undervalued:

Hermes 30cm Himalaya Birkin

- Upside – 129%

- Current Market Cap – $60,000

- Inferred value – $137,500

- Trading details – Trading on Rally 7/26/21

Mickey Mantle 1962 World Series Bat (signed)

- Upside – 100%

- Current Market Cap – $90,000

- Inferred value – $180,000

- Trading details – Trading on Rally 7/26/21

Superman #14 9.4

- Upside – 83%

- Current Market Cap – $65,520

- Inferred value – $120,000

- Trading details – Trading on Rally 7/28/21

Daredevil #1 9.6

- Upside – 32%

- Current Market Cap – $90,703

- Inferred value – $120,000

- Trading details – Trading on Otis 7/28/21

Assets that may be overpriced:

Mike Tyson 1986 Panini Supersport BGS 9 x 2

- Downside – 79%

- Current Market Cap – $56,500

- Inferred Value – $12,000

- Trading details – Trading on Collectable 7/30/21

George Orwell: Animal Farm First Edition

- Downside – 74%

- Current Market Cap – $29,250

- Inferred Value – $6,500

- Trading details – Trading on Rally 7/22/21

John Elway 1984 Topps PSA 10 x 2

- Downside – 57%

- Current Market Cap – $29,750

- Inferred Value – $12,666

- Trading details – Trading on Collectable 7/27/21

Mookie Betts 2014 Chrome Prospect Auto BGS 9.5 x2

- Downside – 51%

- Current Market Cap – $61,500

- Inferred Value – $30,200

- Trading details – Trading on Collectable 7/28/21