I thought it’d be fitting to continue on a theme of collective ownership through the lens of a new startup called The Drivers Cooperative, a driver-owned ridehailing co-op that is 100% worker-owned.

They offer a compelling business model based on profit-sharing, and are raising $2.5m through a WeFunder campaign.

DAOs are all the rage right now. But you don’t need to be a DAO to build a cooperative.

Let’s go

Table of Contents

Podcast

I recorded a podcast with Jason Prado, CTO of The Drivers Cooperative.

Jason’s story is cool. In 2020, he left Big Tech (he worked at Google and Facebook) to help build this visionary rideshare cooperative.

We recorded this podcast a few months ago, but I never found the right time to publish it. With all the recent attention on DAOs, and given their crowdfunding campaign is ending soon, the time is now.

What is a cooperative?

A cooperative (co-op) is a business structure where the majority of ownership, voting, and decision-making power lies with members of the cooperative.

With traditional corporations, the biggest stakeholders are typically the founders and financiers. Serving the interest of these stakeholders has plenty of pros, but it can result in prioritizing growth & profits at the expense of workers’ rights and benefits.

Co-ops aim to create a sustainable business that primarily serves the interests of its employees and customers.

There are two main types of cooperative businesses: consumer-owned and worker-owned.

Consumer-owned cooperatives

Consumer-owned cooperatives primarily focus on customers.

A famous example of this is REI. They give every customer who spends over a certain amount a member dividend based on its annual revenue.

When the company does well, members get a nice cut. Not every year is good though. REI had a tough year in 2020 due to lockdowns. But while they couldn’t distribute a dividend, but still gave qualified members 10% cashback at REI stores.

Some co-ops give members a vote in governance decisions. With traditional corporations (and modern DAOs), shareholders get votes proportionate to the number of shares owned. But cooperatives typically have a ‘one member, one vote‘ policy which distributes decision-making equally among all members.

Worker-owned cooperatives

In a worker-owned co-op (such as The Drivers Coop), the employees own most of the company’s shares. This means employees also largely control the voting power.

One great example of this is Spain’s Mondragon Corporation. It started out selling paraffin heaters, but the cooperative now runs 260 different companies and employs 81,000 people — meaning it has over 3x as many full-time employees as Uber & Lyft combined.

So, what makes ridesharing an industry worth attacking?

The problems with ridesharing today

When Uber came about in early 2009, their promise was to:

- Disrupt the careless, indifferent taxi company monopoly

- Reduce prices

- Provide drivers independence

Goal #1 was a clear success. Taxis were a pretty bad experience, and a better option was long overdue. Who could argue with that?

However, it’s fair to say goals #2 and #3 failed.

While ridesharing companies have enabled new employment opportunities for millions of drivers, this has come with some tremendous costs. Fuel, insurance, registration, cleaning, and vehicle maintenance are all expenses that drivers must pay for themselves.

But more importantly, the companies have obliterated any sense of stability. Classifying drivers as independent contractors has allowed Uber to save 100s of millions of dollars in labor costs. It has made shareholders (mostly) happy, but also means drivers lack basic employment benefits. There’s no healthcare, no overtime, no sick leave, nothing.

Battles lines are being drawn over this. Courts in Britain and Amsterdam have ruled Uber drivers to be employees and not independent contractors. Uber plans to appeal these, and will spend millions lobbying & fighting.

But drivers lack any real representation in this fight. Unions have struggled to get off the ground, and since the pandemic, ridesharing companies have been facing supply and demand challenges — further exacerbating the problem.

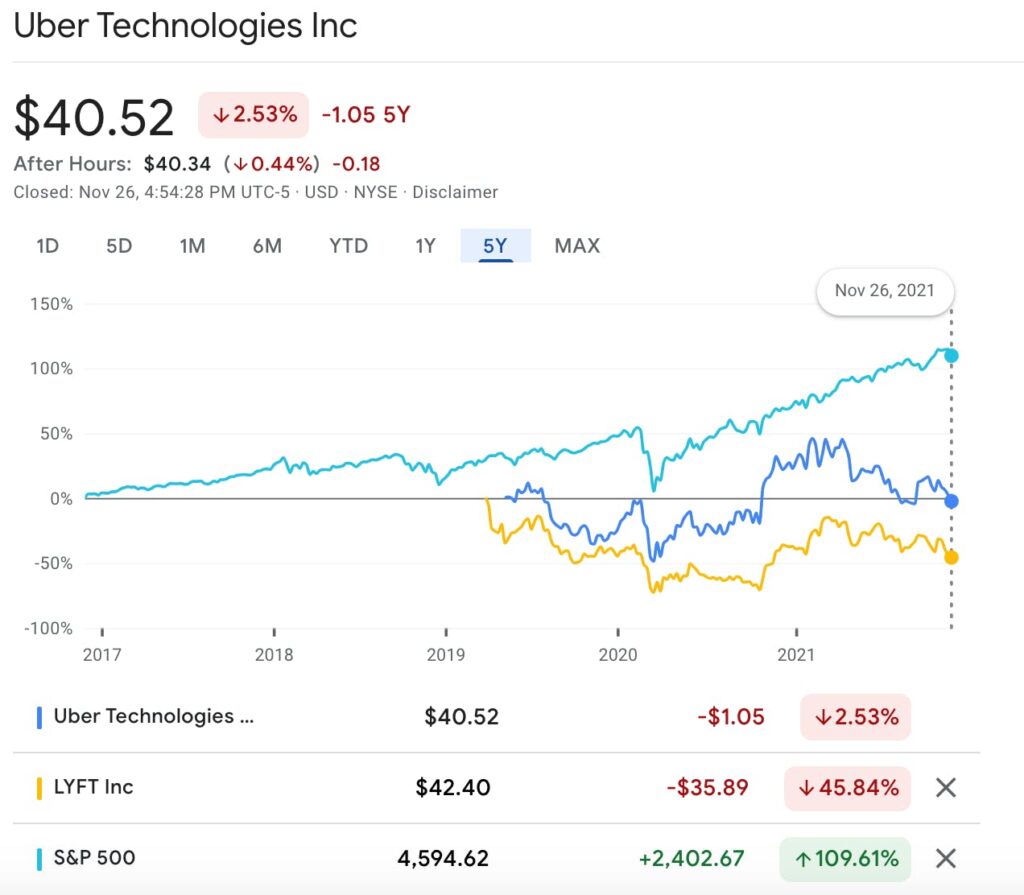

The days of cheap, VC-subsidized rides are over. Uber & Lyft are public companies now, and Wall Street demands a real return. Over time, both companies have steadily increased their prices. It’s come to the point where they are often now more expensive than taxis!

The supply of drivers is still low. Yet despite increasing fares, driver pay is decreasing.

And to top it all, these companies still aren’t making any profit. Uber’s share price is flat since IPO. Lyft’s is down 45%, while the S&P500 is way up.

So to recap: Prices are up, profit is negative, and drivers are earning less than before.

What have we gained here? A marginally better taxi experience you can do through your phone, sure. But at what cost?

The promise of ridesharing has fallen short of expectations. The model is clearly flawed and could use a rework.

Enter The Drivers Cooperative.

What is The Drivers Cooperative?

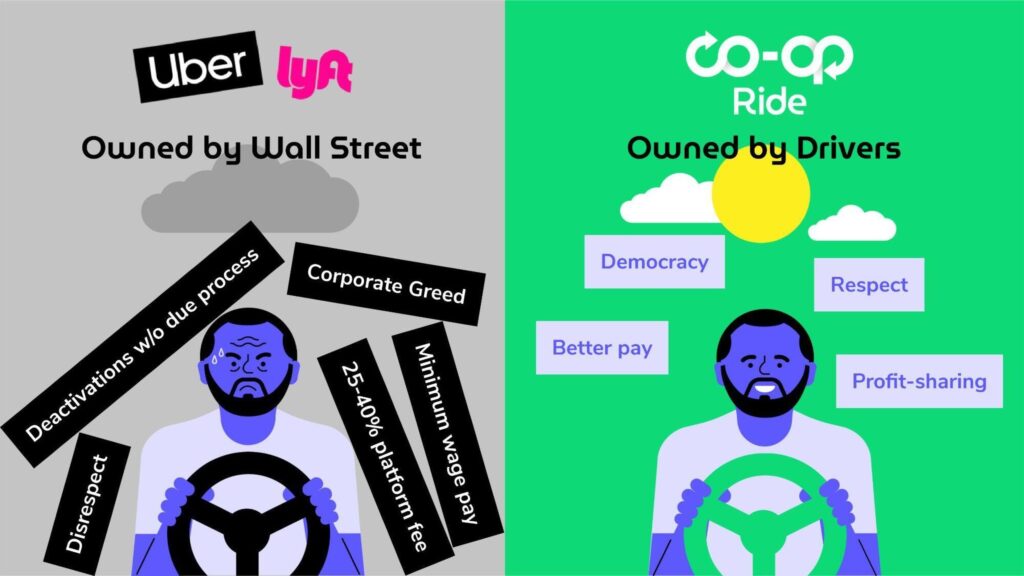

The Drivers Cooperative is an unconventional startup with a clear vision: To be a 100% worker-owned alternative to Uber & Lyft which offers a better deal for riders and drivers. They strive to pay drivers more and restore their dignity.

The coop was founded by career driver, a Google executive, and Jason Prado, a Silicon Valley engineer & labor organizer.

While working at Google & Facebook, Jason noticed the companies were hiring a disproportionate number of temporary contractors, who aren’t eligible for basic employee benefits, including healthcare. Google in particular has come under fire for this practice. Temps at Google now outnumber full-time employees, with temp employees claiming they are a drastically underpaid “shadow workforce.”

In 2016, Jason lost his passion for Facebook’s vision and even helped organize a labor movement within the company (!) He realized he wanted to invest his time in things that made a positive difference in the world, and to do that, he had to leave Facebook.

After leaving Facebook, he decided to get politically involved, joining the Bernie Sanders campaign as a data engineering consultant.

In 2020 during the throes of the pandemic, the Drivers Cooperative was hatched. (That’s right, just like Alternative Assets, it was a lockdown baby.) Jason loved the idea and immediately got involved.

How does The Drivers Coop work?

The Drivers Cooperative uses an entirely different business structure to traditional ride-sharing companies, where every driver owns a share in the company. This gives them a vote on governance issues such as worker’s rights, company development, and leadership decisions.

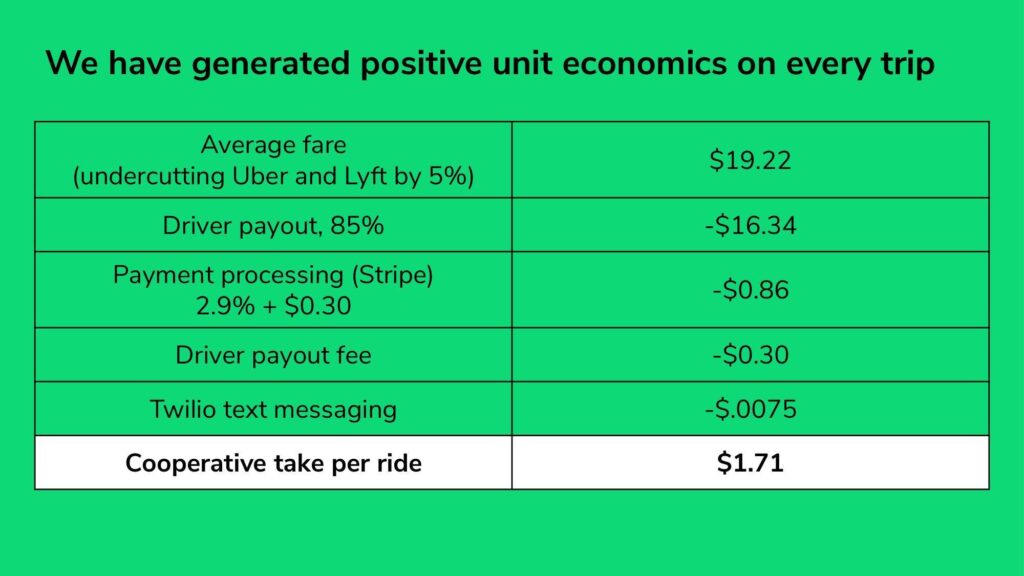

Their compensation for drivers is drastically higher. Uber’s payout rates for drivers vary, but workers typically keep between 60% – 75% of each ride’s revenue.

Because The Drivers Cooperative is member-owned, the Board of Drivers has decided that the workers get an 85% cut of each fare.

This is a significant difference in driver pay. But what’s more significant is the difference in how these figures were determined. At Uber, rates are decided by a cohort of data scientists, game theorists, executives, and algorithms. But critically, none of these people are drivers.

In comparison, The Drivers Cooperative’s revenue-sharing figures are determined by those who actually drive. They’re able to set policies on economics, business expectations and acceptable customer behavior. All drivers and members have a vote and can participate in board meetings.

Profit sharing

Not only are Coop drivers earning 8-10% more per trip than competitors, but company profits are funneled back to drivers through profit-sharing.

While most traditional business models distribute profits as dividends, The Drivers Cooperative operates under a surplus model. Any annual surplus is split among members and re-invested into the business.

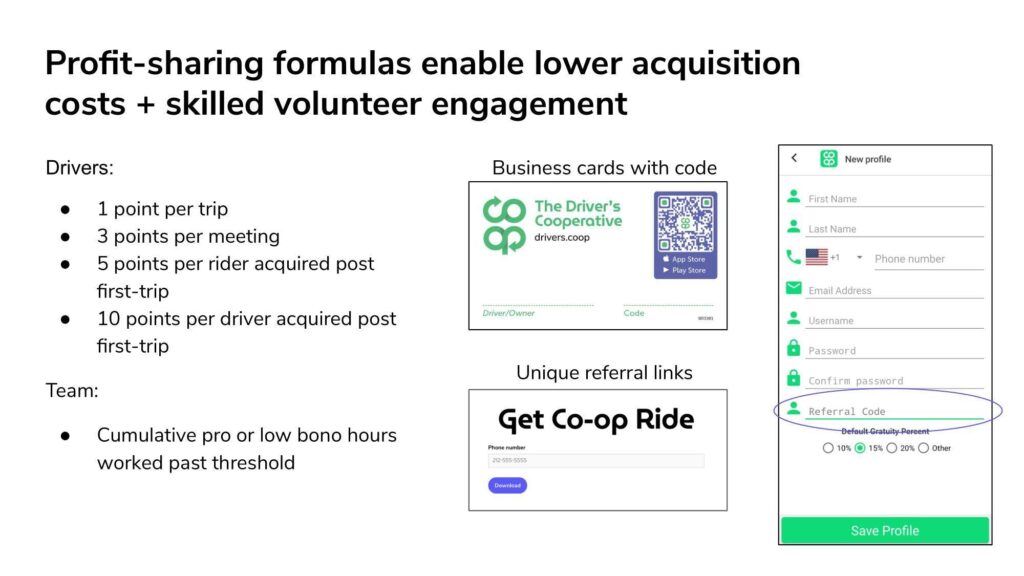

The way this surplus is disseminated depends on each driver’s Patronage Points. Drivers and members earn points based on their involvement in the Cooperative’s ecosystem. For each trip they make, business meeting they attend, or customer they refer, they receive points. These points determine the weighting of surplus they receive.

A core business principle of The Drivers Cooperative is that we are all human, and our time is equally valuable.

It’s how we invest our time that matters.

Co-Ops vs DAOs: What’s the difference?

Remember that cooperative structures are nothing new.

The world’s first coop, The Fenwick Weavers Society, dates back to the 1770s and is still around today. Back in college, I was part of a student-run coop that was considered a crazy, socialist idea — even for Umass Amherst. (There were seven student-run collectives on campus, but the Isenberg Business School disassociated with them completely.)

Yet fast-forward to 2021, and suddenly cooperatives are cool again — except now they’re called DAOs!

How are DAOs and Co-Ops similar?

DAOs are essentially cooperatives. There’s not much difference between the two. As others have pointed out, DAOs are novel, but not new.

DAOs and co-ops both incorporate the same key elements:

- Treasury

- Governance voting

- Community messaging platform

- A native token that can be used within the organization (i.e., patronage points)

Just like with DAOs, voting power is decentralized and distributed to contributors. Sure, with DAOs it’s managed by computer code. But the voting power lies with the community.

In a sense, cooperatives represent the original decentralized governance. But to be fair, there are some crucial differences.

How are DAOs and Co-Ops different?

Firstly, while co-ops may have something resembling a “native token” for members, it isn’t tied to the blockchain. This means it cannot be re-invested to earn interest like crypto tokens can (what’s known as staking).

Secondly, voting power in DAOs is often distributed based on the number of tokens owned by each individual. This proportionate issuance of voting power closely resembles a typical business “shareholders” business model, instead of the “one member = one vote” structure often (but not always) found in cooperatives.

It’s interesting to note that The Drivers Coop is already ahead of the ball here. By tying patronage points to engagement & activity, The Drivers Coop is enabling a forward-thinking, progressive form of ownership that is highly conducive to DAOs…

Capitalistic and socialistic DAOs

But outside of these slight differences, DAOs are essentially a “cryptofied” version of cooperatives. If crypto and DeFi continue to skyrocket over the next decade, the dignified structure of DAOs may be seamlessly adopted by cooperatives in the future.

I believe altruism will be the single most compelling and effective use case for DAOs.

And not a moment too soon, either. Wages, markets, and assets are up, but charitable giving is down.

In the meantime, for-profit collective ventures are sucking up all the oxygen in the room. VCs are funding DAOs, and DAOs are challenging the VC model. VCs are becoming DAOs, and DAOs are becoming VCs.

We’re coming full circle, layering a hyper-capitalistic model on top of what is, at heart, a fundamentally socialist idea!

The irony is not lost on those paying attention.

Managing supply & demand

Starting a marketplace from scratch means solving the “chicken & egg” problem. You need supply to fuel demand, but you need demand to fuel supply.

For The Drivers Coop, demand isn’t really a problem. Plenty of people are frustrated with Uber and looking for cheaper alternatives.

They’ve been live less than a year, but drivers already made over 4,000 rides. And unit economics look strong.

The challenge lies on the supply side. Part of this is due to geography. New York City (where the business is based) is a bit of an anomaly when it comes to ridesharing — most drivers are professional and are effectively working full-time. Too much is at risk for them to leave.

Still, they’ve already managed to lure away approximately 3,500 drivers — most of whom are ex-Uber/Lyft folks fed up with feeling like a pawn.

Growth & challenges

The Coop has ambitious expansion goals. They’re based in NYC but want to expand globally.

Stealing market share from Uber & Lyft will be very difficult. Uber alone plans to spend $250 million on driver incentives next year. Much of this will be used to increase drivers’ take rate, and to provide bonuses for completing multiple trips. The Drivers Cooperative won’t be able to compete like that.

But it’s important to remember is that success looks very different to the cooperative than it does to a company like Uber.

A successful cooperative is a sustainable business that grows YoY, and most importantly, supports its members. As long as members are happy, earn money, have a say in decisions, and share in the profit, the business is a success.

How to invest in The Drivers Cooperative

The Drivers Coop is running a campaign on WeFunder, which has raised over $1.4 million so far.

They have a goal of $2.5m, but if you want to invest in this company, the time is now. Jason recently mentioned they are happy with how much they’ve raised so far, and are closing the fundraising in three days.

Investment structure

It’s important to note what exactly you are investing in here. You are not buying equity in the company itself, and you are not buying Patronage Points.

The Drivers Cooperative is raising debt through a revenue-based financing model. Think of this not as an investment in shares of the company, but more like a loan.

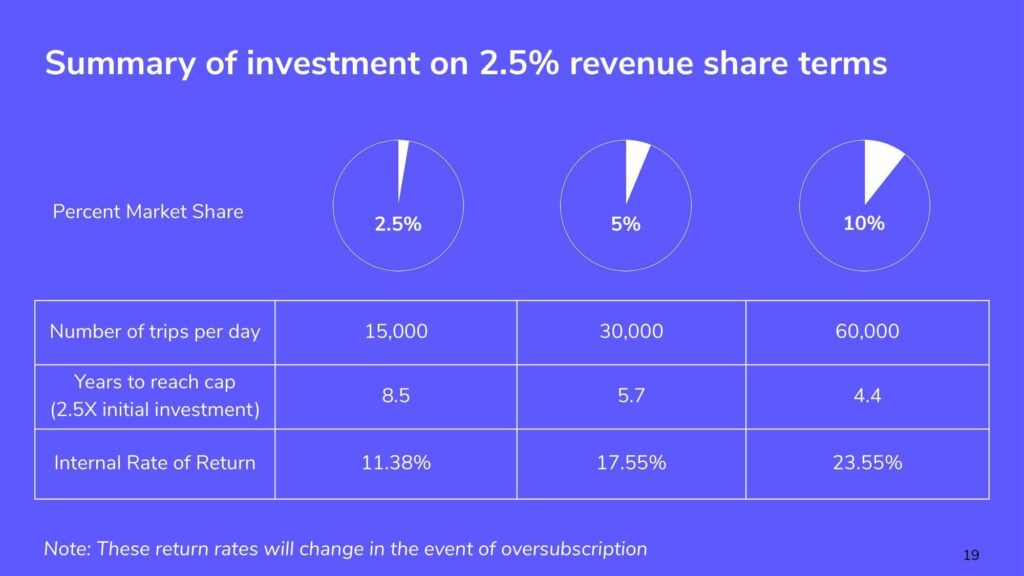

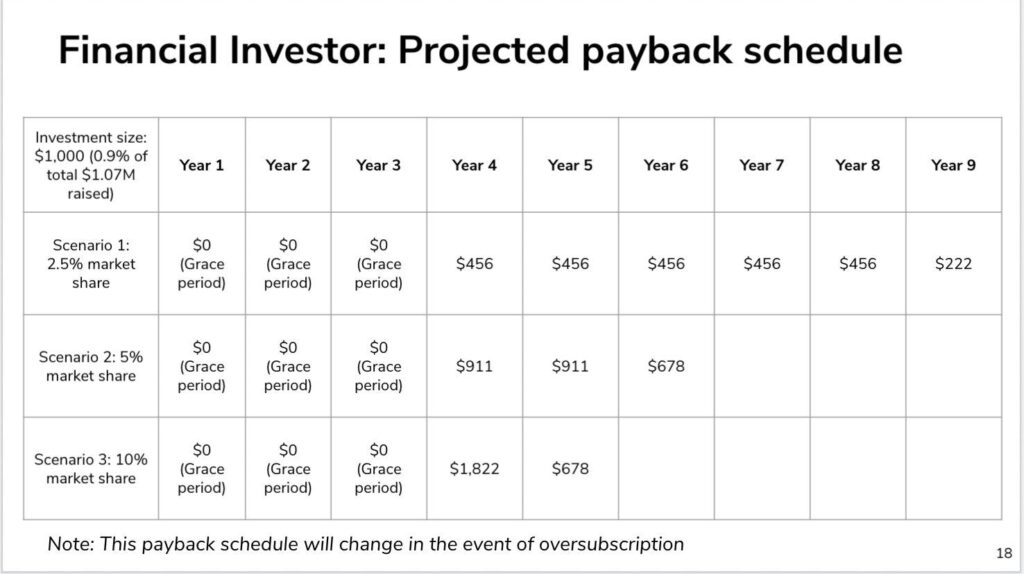

After a 24 month grace period, investors (i.e., lenders) will receive 2.5% of revenues each quarter, with a maximum payout of 2.5x the initial investment.

So, for example, if you invest $10k, you will receive a maximum of $25k in return.

According to their revenue model, if The Drivers Coop manages to capture 5% of NYC’s rideshare market, lenders will receive the maximum 2.5x their investment over 5.7 years.

It’s worth noting that there is a risk involved – once the ten years are up, you will no longer receive recurring payments, even if you haven’t recouped your original investment.

By investing, you’re essentially making a bet on the company’s ability to achieve at least 2.5% of the NYC rideshare market within a decade — which is extremely doable. The greater the market share they achieve, the quicker you’ll get paid back.

Other ways to invest

These potential returns are certainly good, and compared to the typical startup the risk is relatively low. Sure, there are other ways to earn 2.5x on your money over the next ten years. Heck, you could probably make 2.5x over the next ten days by betting on the right meme coin.

But investing is about so much more than immediate returns. Investing is also about contributing to something you believe in. It’s about effecting change.

The Drivers Cooperative presents a great investment opportunity for those looking to make a difference in the current ridesharing landscape.

Furthermore, investing doesn’t have to be done with money; it can be done with time, effort, and social capital. If you want to get involved without investing money, the cooperative has plenty of opportunities. They are always looking for talented people to join the team, including engineers, operations, admin roles. Put your skills to work and build something you truly believe in.

Conclusion

The line between Cooperatives and DAOs is thinner than people have seemed to acknowledge. The former has been around for centuries, existing as sort of a mildly anti-capitalist undercurrent within a larger capitalist system.

The latter is coming out of the gate hard, with billions of gigahertz of computing power, and new capital flowing in from angels, solo funds, and institutions.

In order to progress, these two worlds need to merge together. Luckily, it’s never been easier.

One of the greatest things about the world today is our ability to vote with our dollars, to easily put our money where our mouth is. After all, this is the promise of DeFi — a frictionless, permissionless way to funnel capital into companies & ideas we believe in.

But while DeFi makes this easier, you don’t need DeFi to effect change. Sometimes the structure is already there, and has been for centuries.

If you have any questions, or would like to get in contact with Jason Prado, you can find him on Twitter (@jasonpjason), or via email: ([email protected])