Welcome to Sports Cards Insider. We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

Today, we’re covering investment opportunities for Tom Brady, LeBron James, and Tiger Woods:

- 2003 – 2004 Topps Chrome NBA Hobby Box IPO’ing on Collectable

- Tiger Woods 2001 Upper Deck BGS 10 Black IPO’ing on Rally

- Tom Brady 2000 Bowman Chrome BGS 10 on Collectable

Insiders get one dedicated email for each asset with more analysis, comps, and full valuations. We also give the AA Verdict for each card: a straight up Yes or No. Free members only get a weekly roundup.

Table of Contents

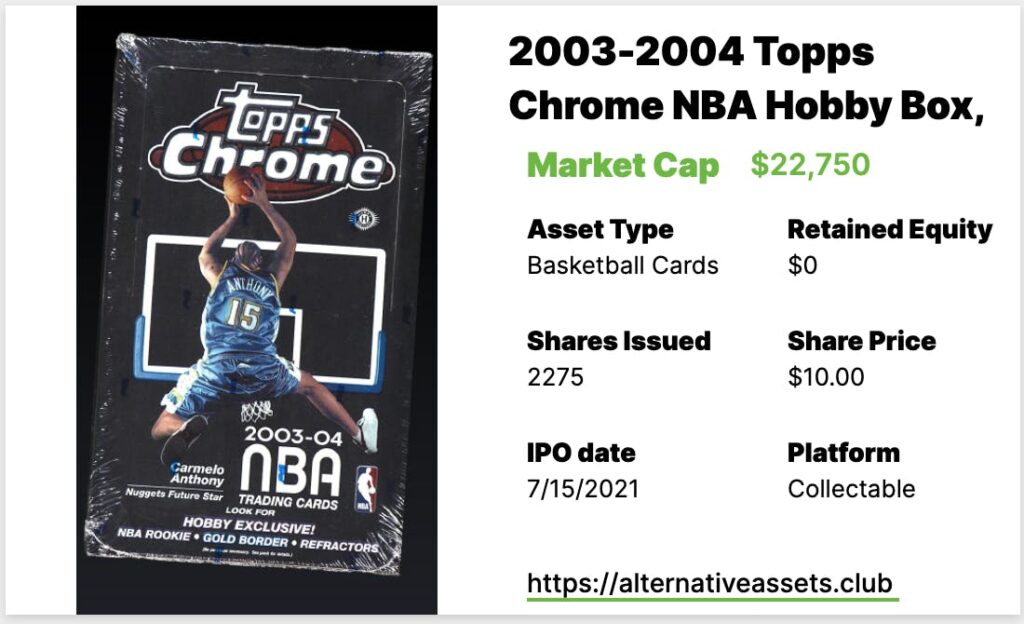

2003-2004 Topps Chrome NBA Hobby Box, Sealed

About the asset

This is a sealed box containing 24 packs of cards, four per pack.

This set contains rookie cards for LeBron James, Chris Bosh, Dwyane Wade, and Carmelo Anthony.

In a sealed box, you should expect to get:

- Eight base refractors

- Two rookie refractors

- One x-fractor

- 50% chance for an autograph or relic card

It’s identical to another box that IPO’ed on Otis 5th April 2021.

For this asset, Insiders also learned:

- Projected growth trend

- Full valuation

- Asset class volatility

- Our verdict on the asset as an investment

About the drop

This asset will drop on Collectable 14th July at 2:30 EST with a market cap of $22,750 and no retained equity. From then, there will be around ten week lockup before trading begins on a quarterly basis.

Get $5 free on Collectable using code DESAXJ.

Add IPO to calendar

About the athletes

We’ve also covered Wade here and Carmelo Anthony here.

The main thing you’re realistically hoping for with this box is a LeBron James refractor or Black Refractor, and we’ve covered his significance extensively.

Recent sales history and Valuation

[Detailed Valuation for Insiders]

Inferred value is $20k to $25k.

Other ways to invest in LeBron James

This asset is essentially an investment in LeBron James, and if you want to put a bet on him, there are some better options that are both trading now and represent a better valuation.

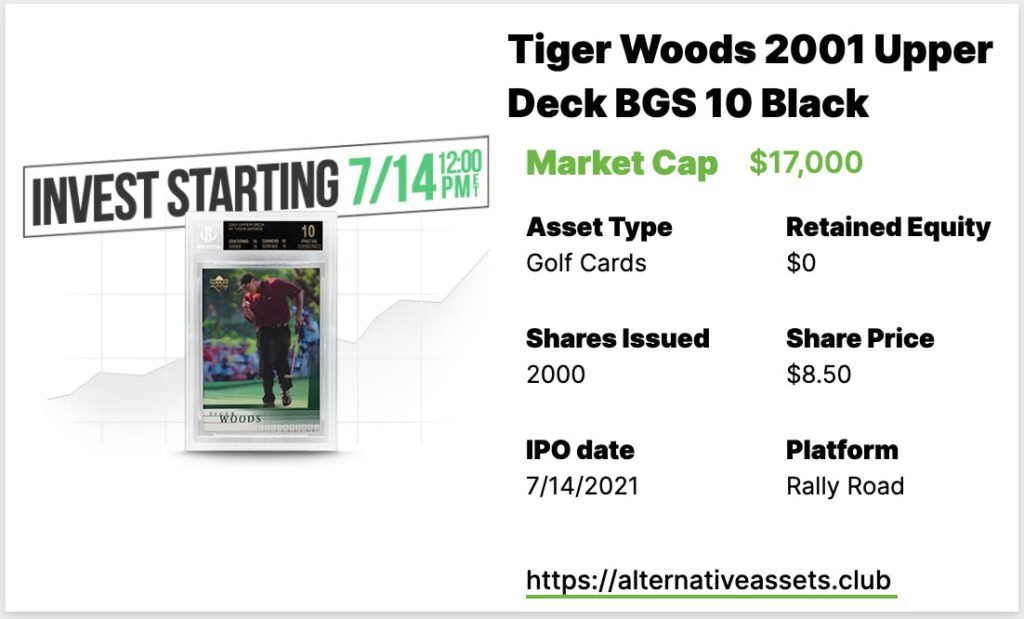

Tiger Woods 2001 Upper Deck BGS 10 Black

About the asset

This is a BGS 10 Black Label (that means all four subgrades are 10s) Tiger Woods rookie card from the 2001 Upper Deck set.

Only 0.3% of the 2001 UD Tiger Woods cards have been graded Black Label. Unfortunately, the denominator is quite large here — there are 89 black label cards in circulation, which is quite high.

For this asset, Insiders also learned:

- Projected growth trend

- Full valuation

- Asset class volatility

- Our verdict on the asset as an investment

About the drop

This asset will drop on Rally 14th July at noon EST with a market cap of $17,000 and no retained equity. From then, there will be around five month lockup before trading begins on a quarterly basis.

Add IPO to calendar

About the athlete

Tiger Woods is one of the best one or two golfers in history. Read our analysis of Tiger Woods.

Recent sales history and Valuation

[Detailed Valuation for Insiders]

Inferred value is $10k to $15k.

Other ways to invest in Tiger Woods

There’s a good case to be made that Tiger Woods is a good long-term investment. If you want to bet on him making a comeback, there are a couple of undervalued assets over on Collectable that you may want to look into.

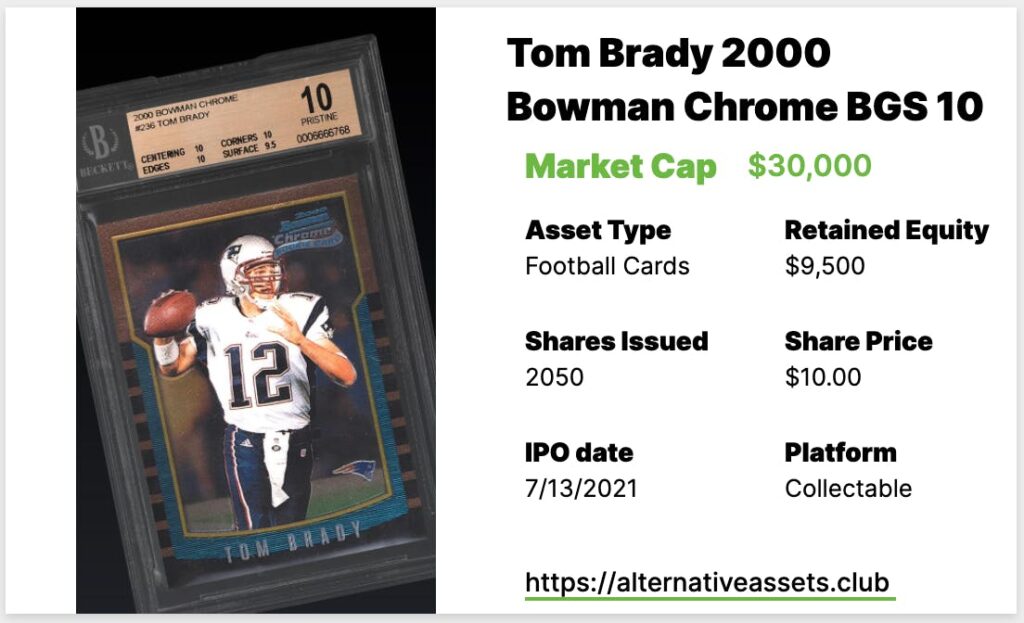

Tom Brady 2000 Bowman Chrome BGS 10

About the asset

This is a BGS 10 graded 2000 Bowman Chrome Tom Brady card. Of 3,547 cards submitted to BGS, 102 have received a 10 with two earning 10 Black. There are an additional 3,442 of these with PSA (1,081 received a PSA 10), and potentially more with other grading services.

Note, this is *not* the refractor card, which is significantly rarer. I point that out, because of these three quotes from the Collectable write up:

- “one of the most important and iconic modern era productions”

- “a world-class commodity which should be heavily pursued by every investor”

- “there are few modern issues which hold the lure and desirability of the coveted 2000 Bowman Chrome Refractor Brady rookie.”

All three refer to the Refractor version of the card, not the base version. Link the the first quote, the second, and third.

There was another similar quote that I couldn’t find the source for.

They also say there are 108 BGS 10s, but Beckett only shows 102. They do show the correct figure later in the write up. Not sure what’s going on with this one ????♂️.

For this asset, Insiders also learned:

- Projected growth trend

- Full valuation

- Asset class volatility

- Our verdict on the asset as an investment

About the drop

This asset will drop on Collectable 13th July at 2:30 EST (note new time) with a market cap of $30,000 and $9,500 retained equity (32%). From then, there will be around ten weeks lockup before trading begins on a daily basis.

Get $5 free on Collectable using code DESAXJ.

Add IPO to calendar

About the athlete

Tom Brady is one of the top two or three quarterbacks of all time (many would say number one).

Recent sales history and Valuation

[Detailed Valuation for Insiders]

Inferred value is $25k to $35k.

Other ways to invest in Tom Brady

Brady has been up and down in 2021 peaking just after his Super Bowl win. If you do want to make a bet in Brady, there are several options that are currently undervalued on Collectable that may be a better option.