The NFT space is saturated with supply, with new projects minting every single day. But while most of these projects are honest, others carry nothing but a litany of (soon-to-be-broken) promises.

For this issue, we’re diving into NFT scams, and how to spot red flags when buying.

Let’s go!

Table of Contents

Two sides to every NFT trade

Just like VCs rarely talk about their losses, NFT investors rarely talk about theirs.

Yes, the attention pouring into NFTs has meant some people have made life-changing money. But there are two sides to every trade, and stories of those who lost are big often absent from coverage of the NFT bonanza.

The fact is, there are dozens of NFT scams that have gone from boom to bust within a few months, or in some cases, within a few hours. They’ve lived across the Solana, Ethereum, and Cardano blockchains, and include:

- Evolved Apes, whose creator “Evil Ape” disappeared with 798 ETH ($2.7m)

- Solana Towers, which promised a virtual condo in the metaverse, before the project vanished into thin air, along with 1,881 SOL ($282,150)

- And many more

NFT fraud takes many forms. These were what’s known as a classic rug pull. People should start taking these more seriously, because this is the kind of stuff that, if it goes unchecked for too long, gets governments involved.

These stories are getting lost amongst the excitement & chatter about DeFi, NFTs and Web3.

(Hey did you know that Web3 is going to change everything? Because Web3 is going to change EVERYTHINGGG!)

Even if you believe this, which I actually do, it’s wise to have some honesty about the timing, trustworthiness, and general messiness of it all. For all the talk of the world-changing greatness that DeFi brings, the fact is it also brings a lot of fraud.

There’s nothing to protect you out there. So we’ve written this guide to give you a heads up, and also to encourage you to figure out how NFTs fit into your buying and larger investment strategy.

What is a ‘rug pull?’

A rug pull is defined as a project that is totally abandoned by its creators, effectively destroying the value of any assets that are left behind. The creators typically do this after collecting a large amount of the cryptocurrency.

There’s a difference between a failed project and a rug pull. Just because a project fails does not mean it was a rug pull. The NFT market is volatile, and projects are always at risk of a pullback.

Even Gary Vaynerchuk, one of NFT’s biggest hype men, proclaimed that “99% of NFTs will not be good investments.” Before deciding on a project to invest in (or mint yourself), let that echo in your mind.

How to avoid a rug pull

Use Discord to understand the community

Before investing in any unknown NFT project, there’s one thing you should absolutely do first:

Find. The. Discord.

Discord is one of the most important places, if not the most important, to get a general feel for the project. In the different channels, you get to interact with other members and follow topics of conversation.

Look for substance in the conversations. Get a feel for other members. Try to engage the creators with questions about the technical aspects of the project.

Are the channels overwhelmingly flooded with constant hype, chats centered around floor price, spam from other projects, and more hype? Immediate pass.

If you’re not directly communicating with the creators, look to see if they at least have a presence in the Discord channels. When they are posed with questions, take note of whether or not they respond with substance, or if they create more distractions.

(Psst — we just launched our Discord, and promise it’s not a rug pull! In fact, there is no rug — it’s free to join)

A creator’s tone in responses to fair criticism should also be noted. Remember, these creators should be invested in the long-term success of their project. They should be trying to build a community rather than trying to coerce discussion.

Here’s a first-hand experience of an NFT buyer who candidly shared his experience getting scammed. Note how he describes the Discord channels as full of red flags and yet he still ignored them until it was too late.

Another useful Discord tip is to check the number of members. A high number in a short period could be a red flag. A grassroots following often takes time to build up. It took Zed Run years to get their first 10,000 Discord members, and just a few months to skyrocket to nearly 120,000.

Also be wary of Discords that are too big, and don’t make any sense. If there are 150,000+ members in a Discord chat, chances are the creators fed the Discord a steady diet of fake accounts and Bots.

The bot situation is especially concerning when you consider that pre-mint giveaways are also likely to be issued to the creators themselves, when one of these Bots is, inevitably, proclaimed the winner.

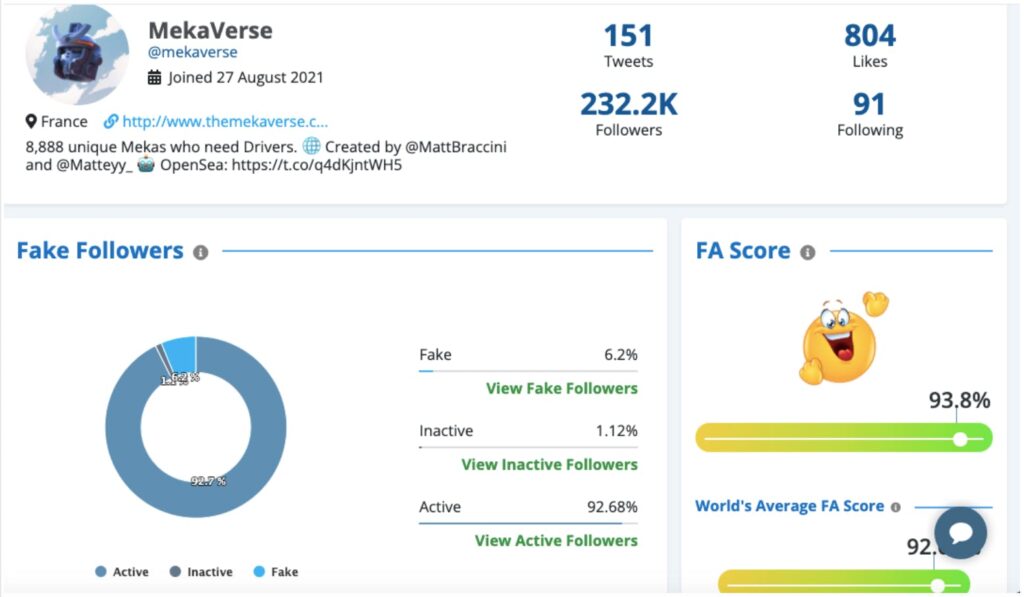

Check for fake Twitter followers

The rules that apply in Discord also apply to Twitter.

Twitter can be a head-spinning sideshow. Hype and allure abound in this space, but the primary focus here is follower count.

Many influencers and projects boast about the number of followers they have like it’s a rite of passage. But a high percentage of these followers may be fake.

Use tools like Followeraudit.com to track how many active, inactive, and fake followers a project has. Their free version takes a sample size of 5,000 followers to use for its findings.

If you’re a frequent NFT buyer, consider buying the upgraded version. It allows you to take a sample size of up to 1 million followers.

Look through the Code

If the project passes the two tests above, that’s great. But if you’re looking to make a large investment in a lesser-known project, you may want to dive into the code.

It turns out you can often detect “rug” code if you look at the project’s smart contract address. Smart contract addresses are a sequence of characters like those on a MetaMask or Coinbase digital wallet. If the smart contract address isn’t readily available, ask for it through Discord.

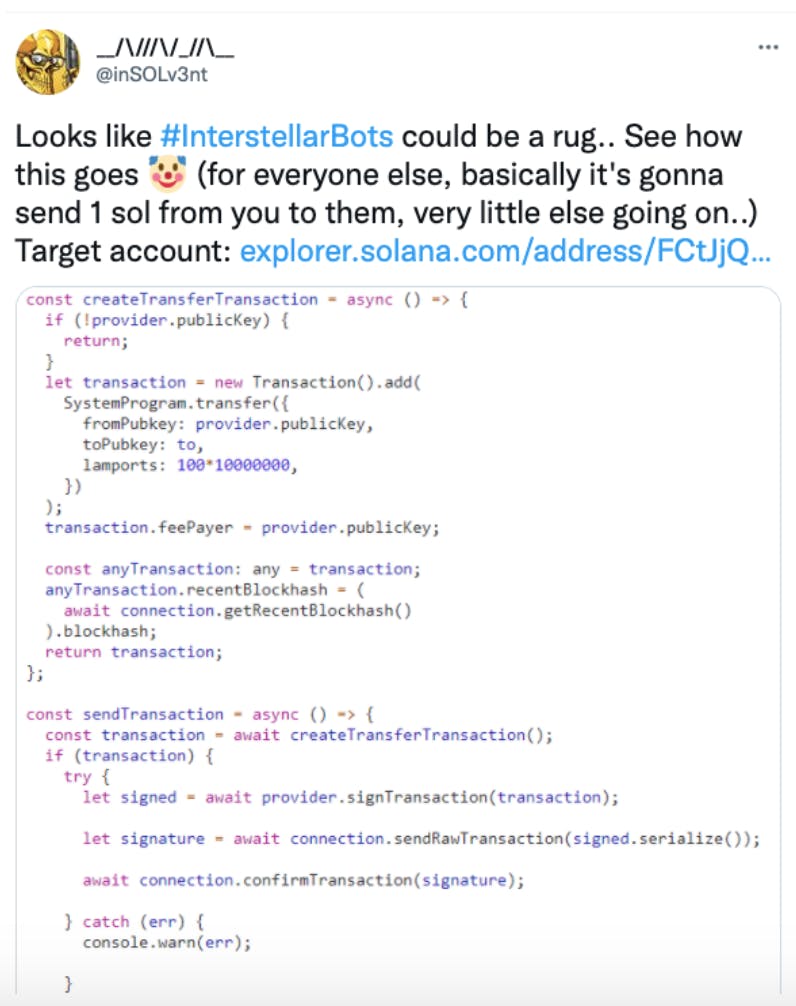

The Solana-based Interstellar Bots scam creators disappeared from all social media the day after minting. But the scam could have been prevented by just looking at the code!

Here’s what one Twitter user found:

Don’t know how to do this? Ask (or hire) a blockchain developer. Or ask the creators for a video walkthrough.

Resistance from uncooperative creators should raise a red flag. This should be an honest, straightforward exchange. They should have nothing to hide.

Video games on the roadmap

This is one of the most popular highlights of recent roadmaps; a promise that the NFT characters will soon be in an NFT video game. However, the amount of work and time required to develop a quality video game takes years, not months.

It’s also common for creators to promise integration with an existing space such as Decentraland. It is common for projects to claim they will buy a piece of land in this metaverse.

Please note, however, that buying land in the metaverse is akin to a real estate developer saying they will buy a piece of land “somewhere on planet Earth.” The claim can be incredibly vague and must be addressed in the project’s Discord.

If you’re fairly certain that a video game is definitely in the works, here are a few more tips to consider:

- Plot & mechanics. What is the NFT game about? What are the game mechanics? If it doesn’t make any sense to you, it’s a bit risky.

- Developers. Do background checks on the developers to make sure they are legit.

- Social authentication. Check for valid websites, social media, publications, interviews, and more.

- Roadmap. Although rug pulls can certainly publish roadmaps, not having one is sometimes indicative of a scam.

- Tokenomics. Is the token designed for longevity? How is it being divided?

- Partners & funders. Do background checks on the project’s partners and make sure they’re legit.

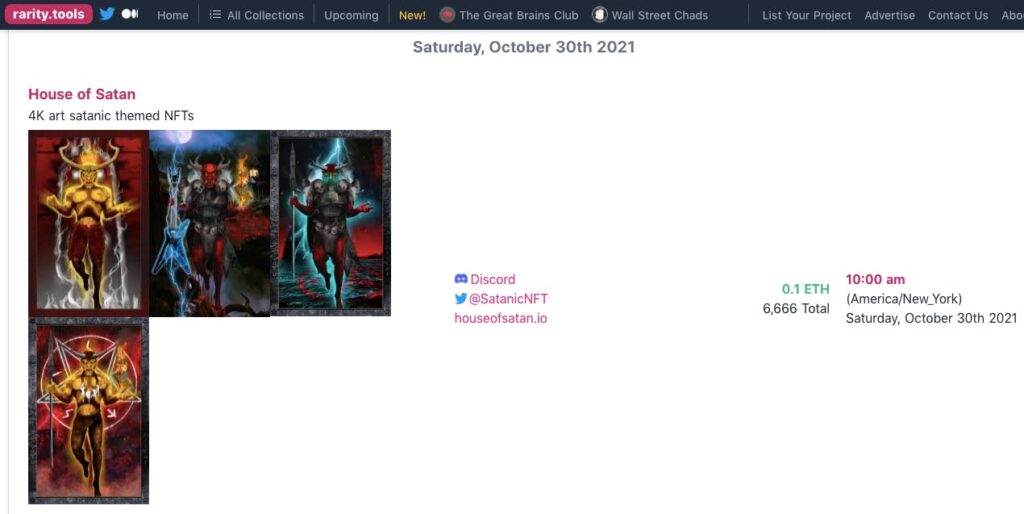

Avoid high minting prices

Avoid projects with high minting prices.

The generally accepted rule is that the minting price should not be higher than 0.08 ETH. (This will change with the rising value of ETH. In the future it may be closer to 0.06 ETH). Look at howrare.is/drops for Solana to see how much each drop is minting for. Rarity.tools/upcoming also has a list of upcoming drops and minting prices.

Avoid high purchase maximums

The number of NFTs that can be purchased per transaction should be limited to a maximum of 5.

If buyers can acquire a large amount per transaction, it can potentially limit the number of participants in a community and kill the project. It also increases “whale risk,” whereby even a small number of whales can throw their weight and heavily influence or distort the market.

Conclusion

Buying NFTs isn’t like buying on Amazon. Nobody is looking out for you. There are no refunds, and there are no protections.

The NFT landscape is becoming littered with scams, many of whom turn to YouTube to vent and alert the world…

NFT investing can be emotional, and most projects fail. Nobody likes to talk about the losses, but it’s a huge part of this game.

Few things are as satisfying as picking the right project, being proven right, and getting a handsome ROI. Yet some investors, despite all the red flags, still cling to the idea of their project’s success at the expense of their better judgment.

Part of the beauty of the blockchain is its openness. But it’s ultimately only as open as people demand. If buyers don’t demand accountability from creators, creators have less incentive to be honest in the first place!

Nobody wants that kind of market. With each new scam, the trust around NFTs (and crypto in general), erodes a tiny bit.

People are ultimately good, but governments & agencies are knocking at crypto’s door. If these scams continue to get bigger, formal investigations and regulation is increasingly likely. If we want to avoid government overreach, we have to learn to govern ourselves.

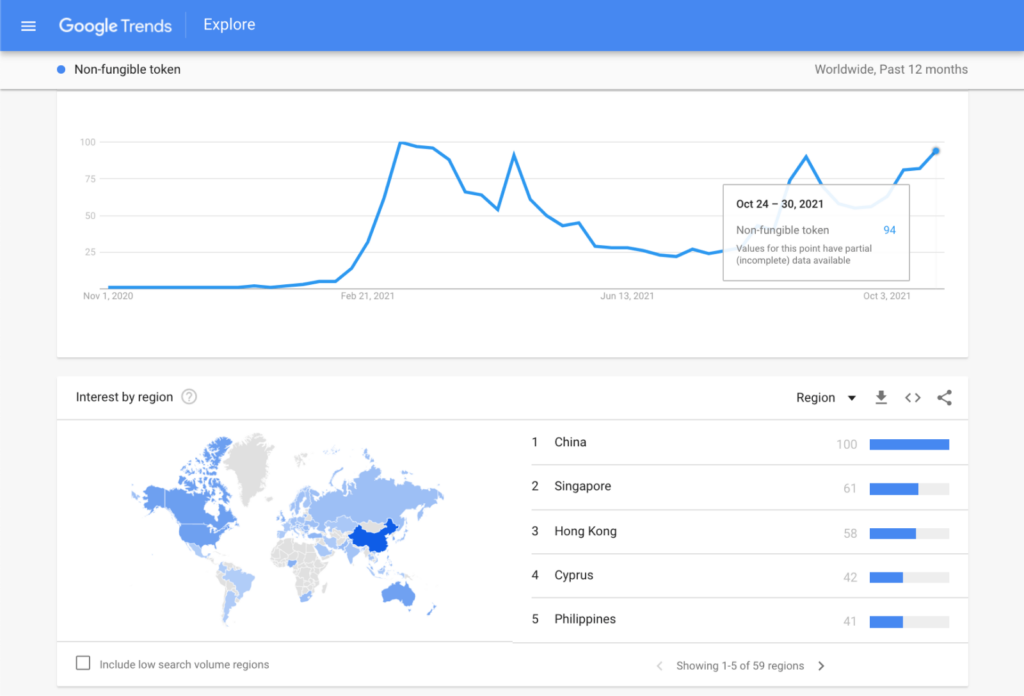

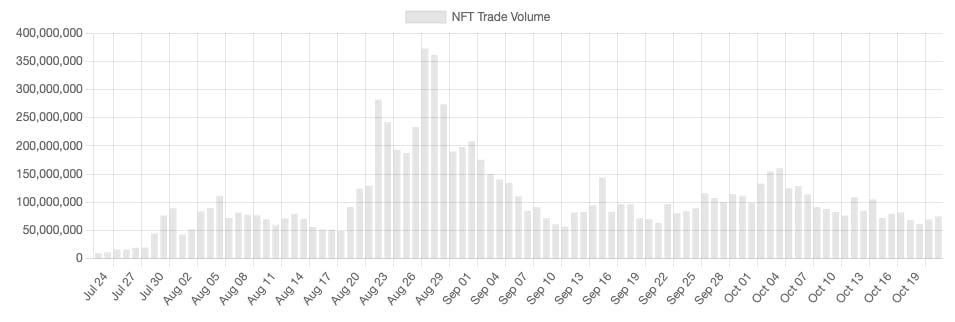

The graph, courtesy of NFT Stats, shows NFT trade volume over the past month. After a frenetic spike in August, the market has cooled back down. We have been at a stable trading level since early September. It’s anyone’s guess what happens next, or where we are in the larger cycle.

But I think this current cool-down period is a good time for NFT investors to take their time, do some due diligence, and really explore the space with a healthy degree of patience.

There is no doubt that the NFT space is worth exploring — and sometimes getting irrationally exuberant about. But our behavior should also mirror that of the graph above.