Today we’re exploring NFT Funds. We’ll focus on two private funds, Sfermion and Meta4, as well as a few public funds that provide retail investors exposure to NFTs and the broader crypto economy.

Finally, I’ll end with some thoughts on this week’s enormous news, ConstitutionDAO, whose sudden grassroots campaign to acquire a copy of the US Constitution saw massive support and ended with an Oscar-worthy twist.

But first…

One piece of feedback we’ve received is that it’s difficult to see all of our latest Buy recommendations in one place.

So we’ve created a new Recommendations page that does exactly this. You can see what we’ve bought, what we’ve passed on, what’s undervalued, what’s overvalued, and how our performance stacks up against the broad fractional index.

(Spoiler alert: We pass on most things. But when we find a good deal, we let you know)

…Okay, now let’s go

Table of Contents

Background: Crypto Funds

While dedicated NFT funds are starting to take shape, pure crypto funds are nothing new.

The first widely acknowledged crypto fund was Grayscale Bitcoin Trust, established way back in 2013 (eons in Internet time).

At the time, Grayscale was a pioneer for providing investors with crypto-backed investment vehicles — specifically exposure to bitcoin. They were the first firm to institutionalize crypto and have launched several altcoin funds since then.

VC firm Andreessen Horowitz first launched its crypto fund five years later, with what was then an astounding sum of $300 million. This past June, a16z announced it had raised $2.2 billion for Third Crypto Fund — a new record.

But just five months later, VC firm Paradigm upped the bar once again. Headed by Coinbase co-founder Fred Ehrsam and former Sequoia partner Matt Huang, Paradigm raised a $2.5b crypto fund — the biggest ever.

Crypto funds provide investors exposure to a broad range of cryptocurrencies and crypto platforms, eliminating the decision on which individual coins, tokens, or assets to buy. They paved the way for the next iteration — NFT funds.

What are NFT Funds?

NFT funds are wholly focused on NFTs as investments.

Considered under the umbrella of crypto funds, they have their own strategies, theses, and focus.

NFTs have had a killer year. A year ago, most people had never heard of them. Suddenly, an entirely new risky, speculative asset class has been created of thin air.

- Bored Apes have been in existence for a little over six months. When they launched, you could buy them for .08 ETH (about $200). As of last week, the average sale price of a Bored Ape was $222k. They’re also turning into a band (and more importantly, a brand).

- The cheapest CryptoPunk now costs $360k, up from its sale price of $43k back in March.

- XCOPY (who we first gave a buy recommendation on in October) is sort of a modern-day Basquiat. He has released an open edition NFT titled “Afterburn” for $999. At the time of writing, the least expensive “Afterburn” edition available on Opensea is 21x more expensive.

The examples above are now considered “blue-chip” NFTs.

NFTs’ have swept past the early adopter phase and are now flooding into mainstream culture. Celebrities have taken notice. It’s no wonder funds and DAOs have formed capitalize on this.

While crypto investment has been in motion since 2017, it has been chiefly about riding the wave. NFT investors hope to capture alpha by becoming early adopters of and investors in emerging Web3 technologies.

Many of the companies providing capital for these NFT funds are Silicon Valley and Wall Street behemoths, including a16z and Gemini, both of whom have backed up-and-coming funds like Sfermion.

Sfermion

Sfermion was founded in 2019 by Andrew Steinwold. (I don’t understand the name, but I think it’s a physics reference.)

With 43,000 followers on Twitter, Steinwold rose to prominence as a leading voice in the NFT space. He used his platform as both a podcaster and author for his podcast and newsletter, respectively called Zima Red.

Steinwold’s gift is in simplifying a space that prides itself on its obtuse language, whether it’s lingo like WAGMI (We All Gonna Make It) or technical like “distributed ledger technology” (DLT).

Ugh, another acronym to learn. I know, I KNOW. ????

Still, his takes are direct yet elegant: The metaverse just means ownership. You don’t need to be fully jacked into the matrix for the metaverse to emerge. As long as we can own our digital selves and stuff online, that is what the metaverse is all about. Crypto is a pure financial game. It’s to make money. But with NFTs, I can be part of a community of people, buy virtual land, attend an event in a virtual world, or buy virtual art. It’s more human-centric.

Steinwold’s investment thesis is to invest in foundational assets for the metaverse. This broad mission certainly relates to NFTs, but he has also focused on early-stage equity ventures and tokens that can be of use in the metaverse.

Sfermion was an early investor in some companies that are now well-recognized as industry leaders: OpenSea, SuperRare, Artblocks and Yield Guild Games, to name a few.

While Steinwold has kept his newsletter updated up to May of this year, the company is notably absent from social media, with the Sfermion Twitter account showing precisely one post in its entire feed.

But that one post is notable for what it links to, which is Steinwold’s first article following his founding of Sfermion in 2019.

In the article, Steinwold writes: Before DLT, it was impossible for a true metaverse to form, because users had no digital property rights. They were under the complete control of corporations that could delete their accounts or destroy their assets at any time. DLT was the missing piece of technology, and its arrival has allowed a true metaverse to emerge where people will live, work, and play for years to come.

For whatever Sfermion lacks in social media, it has made up for it with its business plan. In November, Steinwold announced he had raised $100 million from a cadre of notable crypto investors, including the Winklevii and once again, Andreessen Horowitz.

Blockchain gaming & virtual goods

We first wrote about buying virtual goods in blockchain video games back in May.

Steinwold is particularly interested in this asset class. He feels the idea of gamers having actual ownership of their “stuff” across different platforms is transformative.

For example, let’s look at the ability to purchase a “skin” – a graphic that changes the appearance of a character – that Steinwold often references. An excellent reference point is the hit video game, Fortnite. In it, players battle each other until there is only one left standing.

Never played Fortnite? No worries. Just understand that a big part of the game’s appeal comes from players showing off their skins, by either earning them or buying them in the game.

Skins typically cost between $5– $20. Some cost nearly a thousand dollars. But there is no real ownership, portability, or transferability involved.

If the game developers suddenly pull the plug on the entire Fortnite ecosystem, so too goes all the apps, information, records, and history of the games.

In a scenario like this, the entire game is in the hands of the developers. Not a single shred of “skin” can be taken by the individual, because it is not recorded on a blockchain that gives and verifies ownership to an individual.

Sure, entrepreneurs will find ways to sell their wares. For instance, sellers can use eBay as a third party to transfer funds and then monetize the Gifting feature on Fortnite.

But there are no built-in mechanisms for a direct transfer of ownership. Buyers are essentially purchasing items for which they have zero legal or proprietary rights to. Skins are also strictly limited to the Fortnite environment and platforms.

Blockchain technology changes all this. A player can now have the ability to move a skin from one game to another.

What’s more, rare skins can be featured in digital museums, put up for viewing in someone’s digital home, and transferred across different blockchains (think transfers from Ethereum to Solana).

For example, the Wormhole Token Bridge connects five different blockchains. It allows existing projects, platforms, and communities to move tokenized assets seamlessly across blockchains to benefit from Solana’s high speed and low cost.

This concept is transferable to more than just in-game skins. Other items, weapons, achievements and game data will have permanent records on the blockchain.

Meta4 Capital

Meta4 is an American investment firm based out of Miami. (Okay, this name I understand! It’s a metaphor!)

Meta4’s philosophy is that traditional financial and social frameworks will soon be disrupted by the world of decentralized finance and blockchain tech. They think NFTs are a gateway to a more connected, more intelligent internet, and they want to be at the forefront of this new frontier.

Meta4’s managing partners are Brandon Buchanan and Nabyl Charania, who are in the process of raising $100 million fund to invest in “rare and exciting non-fungible tokens.” The company is relatively small, employing five people in finance, technology and cryptocurrency.

Meta4 has also received backing from, you guessed it, Andreessen Horowitz. They first received $1.1 million in a “pilot fund” and have since endeavored on raising a $100 million with a16z contributing an undisclosed amount.

Buchanan and Charania have stated that they have one quarter of the targeted funds so far, and are looking to fill in the remaining $75 million in the coming months.

They intend on collecting tokens from a range of trendy, “blue-chip” NFT collections. (It feels odd to call any of this stuff “blue-chip,” but it’s all relative.) Put simply: their strategy is to identify and invest in the world’s best NFTs.

And they’ve already deployed some capital into the usual suspects.

Their portfolio/vault includes:

- CryptoPunks: (They own 2 punks)

- Bored Ape Yacht Club: (They own 1 bored ape and 2 mutant apes)

- Zed Run (30 horses)

- CrypToadz (4)

- Gutter Cat Gang: (1 cat)

- The Sandbox: (6 parcels of land)

Another compelling thing about Meta4 is its diverse representation. The business wants to be “an example for minorities” who are typically underrepresented as investors (especially in the NFT space).

There seems to be a growing rift in value between NFTs that are just a .jpeg file, and NFTs that have utility – including community, special Discord access, metaverses you can participate in or game items you can buy and trade for digital currencies, or those backed by physical goods.

It seems that Meta4 has recognized this, as they’ve included several metaverse and game-related NFTs in their collection, mainly in the form of Zed Run horses and land from The Sandbox. This will help mitigate some massive risks, but it still feels extremely tenuous unless they buy the right NFTs ultra-early.

Can I invest in Sfermion and Meta4?

Probably not. At the moment, Sfermion and Meta4 are private investment funds.

Sfermion’s fundraising is done, so there’s no chance of investing until they raise the next one. Meta4 has no options for public investors to get involved other than contacting the management team directly.

Privately held funds like these are for accredited investors only, and you’ll likely either need connections to the team, a fantastic cold email, or deep pockets, so they decide to take your money over some other Joe Schmo.

Luckily, there are places retail investors can turn if they want broad NFT exposure without direct investment.

What is Galaxy Digital?

Galaxy Digital has been a player in the digital finance world for a little while now. They formed in 2018 by well-known hedge fund manager Michael Novogratz.

Since inception, Galaxy Digital has partnered with significant participants in the cryptosphere. Their initial fund for investors included companies such as BlockFi and Ripple, and they have since raised over $300 million to back operations performed on the EOS blockchain.

They manage more than $2 billion worth of assets, the majority of which is in crypto.

Novogratz says, “crypto assets are the next Internet.” Here he is on Bloomberg TV:

Following in the footsteps of other investment firms, Galaxy Interactive (an affiliate under the Galaxy banner) announced they raised $325 million to expand into NFTs and interactive blockchain gaming.

A large portion of the fund will go towards “blue-chip NFT projects,” such as Art Blocks and some CryptoPunks. They recently purchased Punk #8466 from the CryptoPunk’s collection, setting them back a cool $439k.

It’s worth noting that the NFT fund, unlike some others, isn’t solely composed of digital tokens. Companies involved in the interactive finance, content, social, and tech sectors are also represented.

As part of the fund, Galaxy Interactive has partnered with blockchain gaming companies, including Mythical Games and Bad Robot Games.

Similar to Sfermion, it’s quite possible that the inclusion of a blockchain-based businesses will hedge against the wild swings of the next NFT crash.

Can I invest in Galaxy Interactive’s NFT fund?

As of November 2021, the Galaxy Interactive NFT portfolio is not publicly available for direct investment, and there is yet to be any information on when it will be officially released to investors.

However, investors can purchase Galaxy Digital’s public stock, which gives indirect exposure to Galaxy Digital’s (and therefore, Galaxy Interactive’s) operations.

The Wave NFT Fund

Wave Financial is an investment company with several traditional and venture funds under its management. In August 2021, the company opened up its latest branch, the Wave NFT Fund.

The fund was designed to carry a 70/30 allocation, with 70% of assets in NFTs and 30% in platforms and protocols. Wave is a Registered Investment Advisor (RIA) which means they have a legal duty to work in the interest of their clients and not their mutual fund distributors.

The NFT Fund was created by Les Borsai, who grew up promoting raves in Southern California (which I may or may not have attended) and started his finance career in the music industry.

Borsai is an enthusiastic NFT collector who has been on record saying that the NFT PFP projects remind him of the products of his childhood in the 1980s. He sees NFTs as a movement for young people, citing how the market has allowed a younger generation an opportunity to provide for themselves when the traditional roadmap no longer worked.

Among a slew of financial analysts and other associated agents, the NFT Fund has an employee who goes by the name of Veg Surfer on social media. His job is to be fully ingrained in the NFT world and keep his ear to the ground on the latest trends.

The combination of Veg Surfer, financial professionals and their pricing and valuation models is part of the organic plan that Wave is trying to build through its NFT Fund.

Unlike Galaxy Digital, which can be bought on just about any online brokerage by any investor, the Wave NFT Fund is currently open only to accredited investors in the United States or qualified international investors.

The fund is structured as a three-year closed-end fund. A closed-end fund is a type of mutual fund that issues a fixed number of shares through a single IPO to raise capital for its initial investments.

After three years, the shares will be traded on a stock exchange. However, no new stock will be created and no new money will flow into the fund. The fund’s value will be solely dependent on the appreciation of its underlying assets.

The Rise of ConstitutionDAO

Okay, so NFT funds are getting interesting. But we can’t talk about DeFi or the metaverse without bringing up this week’s biggest news story: ConstitutionDAO,

You’ve probably heard about this ragtag group of Internet nerds who banded together to try and buy “The Constitution.”

There’s a lot of misinformation out there. Here’s the story:

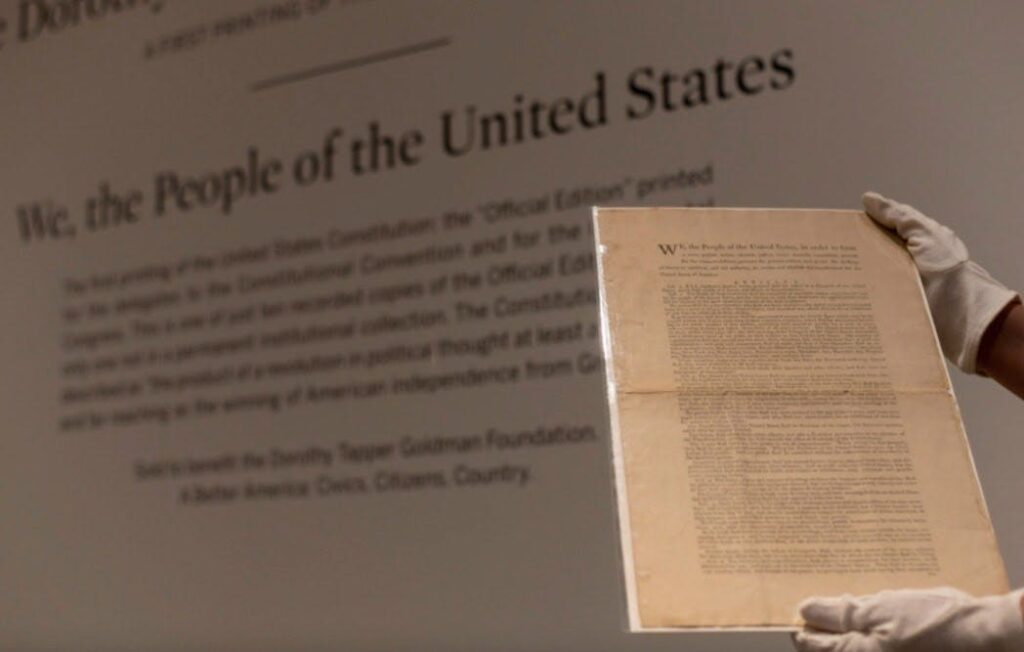

Soon after the Founding Fathers wrote the original Constitution, 500 copies were printed to be distributed to state delegates for their consideration and eventual ratification. The copies were more than reproductions — they were the country’s first living, breathing documents.

Today, only 12 of these remain in the public eye, with just a few remaining in private hands. This is the first time in 33 years that a copy has been auctioned off.

When Sotheby’s listed the item, it estimated it would fetch between $15-20 million. However, one week before the auction, ConstitutionDAO organized a campaign to keep the Constitution from landing in private hands.

Now, it’s essential to understand what this was, and what it was not.

This was not the first time a DAO has bought an ultra-high value asset. It’s been done before. DAOs routinely purchase NFTs and other metaverse goods. And as we brought up last week, PleasrDAO did it with a Wu-Tang album.

PleasrDAO bought the only copy of “Once Upon a Time in Shaolin” from convicted felon Martin Shkreli just last month. They valued it at $4m and sold fractional shares through their token.

Furthermore, there was confusion about how the DAO was legally able to interact with Sotheby’s, and what “ownership” actually meant to those who put money in. This would not have given fractional ownership in the Constitution itself!

We cleared things up in this Twitter thread ????

Still, buying a copy of the Constitution was a watershed moment for DAOs and DeFi at large. More than 17,000 people raised over $40 million in one week!

If meme stocks (especially GME) were the first wave to highlight the power of social media to organize people behind a financial cause or action, then this was undoubtedly the second.

Alas, the effort fell short. The developers claimed overhead, legal, and closing costs for their inability to bid higher than the winning bid of $41 million. (The fact that they publicly advertised their maximum bid before the auction probably didn’t help either.)

The buyer was none other than Ken Griffin, the CEO of Citadel with a net worth of $20bn, who bought it for the equivalent cost of a new iPad. To put icing on the cake, he’s pledged to lend it to a free Arkansas museum!

I mean, talk about a giant middle finger to the DeFi crowd. What an ending…

…Except we all know this isn’t an ending, but a beginning.

Yes, the DAO lost the auction. But even if they won, would this community have been as generous as Ken Griffin? A bit doubtful. I think it’s pretty likely that many of these “investors” would have expected returns — especially given that some high-ish profile neo-funds put in significant money.

Still, in my opinion, this is the start of a much bigger story. Global fundraising. 100% inclusive to anyone/anywhere at any net worth level. 17,000 participants. Over $40 million raised. Massive grassroots support. And all within one week.

Furthermore, this is the kind of story that makes big news outside of Twitter. People may not understand DeFi, but this helps conceptualize it. You better believe this story will be the talk around the Thanksgiving table next week.

The fervor around DAOs is actually fervor around collective ownership. With ownership comes the freedom to explore new ideas + collectively create value. It’s about more than money — it’s about crowdfunding about having a voice. Buying things together is just the start.

This is as beautiful as DeFi gets.