Welcome to Sports Memorabilia Insider. We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

You can view the whole report by clicking here.

Today is a deep dive into three assets IPO’ing on Collectable and Rally Road:

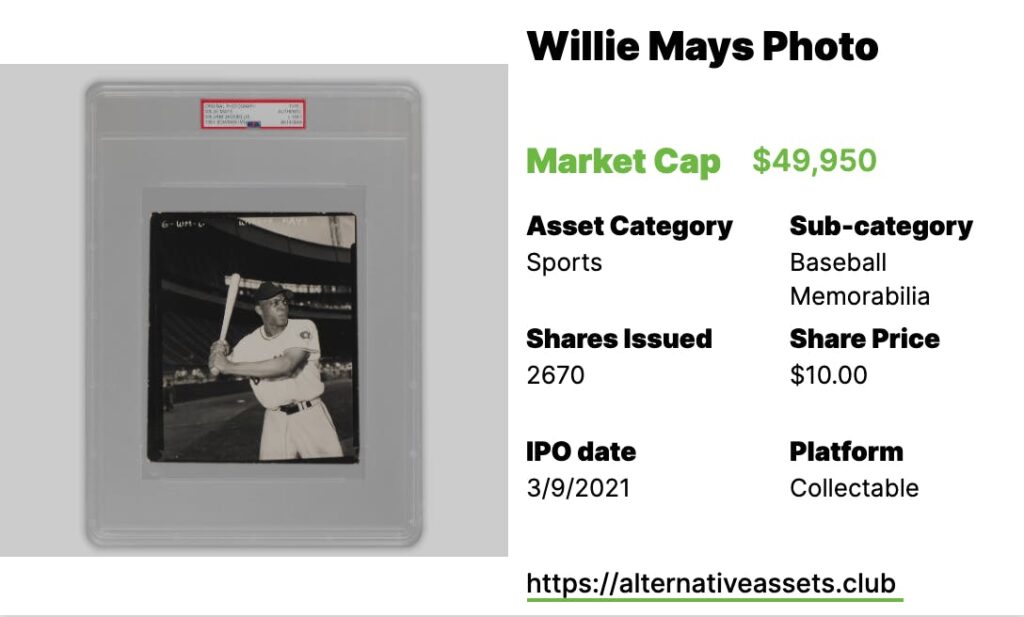

- Willie Mays Photo – IPOs 9th March on Collectable

- Manning, Favre, Marino signed game worn jerseys – IPOs 11th March on Collectable

- Four Signed Hardwood Panels from the Staples Center Basketball Court used during Kobe Bryant’s Farewell Game – IPOs 12th March on Rally Road

Table of Contents

What is the Willie Mays Photo?

First, it’s worth reading Collectable’s article about photos as collectables. It gives a good background on this newish asset class.

A few key things to highlight about this photo:

- It’s authenticated as Type 1 by PSA, which means it was taken from the original negative and produced within two years. Type 1 is the best (it goes up to Type 4).

- It’s actually quite small: 4.75×4″

- The photo was taken by prolific sports photographer William Jacobellis

- The photo was used for the 1951 Willie Mays Bowman rookie card.

It IPOs on Collectable 9th March.

Cultural Relevance

When evaluating a photo, you’ve got to look at both the photo’s subject (Mays) and the photographer (Jacobellis).

Let’s begin with Jacobellis

He was a prolific freelance photographer in the 1950s and 1960s whose shots graced several iconic baseball card sets:

- 1952 to 1955 Bowman

- 1953 to 1958 Topps

- 1952 Tip Top Bread labels

- 1953 Northland Bread labels

- 1955 Robert Gould statue cards

That said, he’s not widely considered to be one of the greatest sports photographers of all time (i.e. the likes of Walter Iooss, Charles Conlon), and none of his photos are listed in any “Greatest sports photos of all time” lists.

He was less of an artist and more of a workman.

You can read more about him and see loads of his photos here.

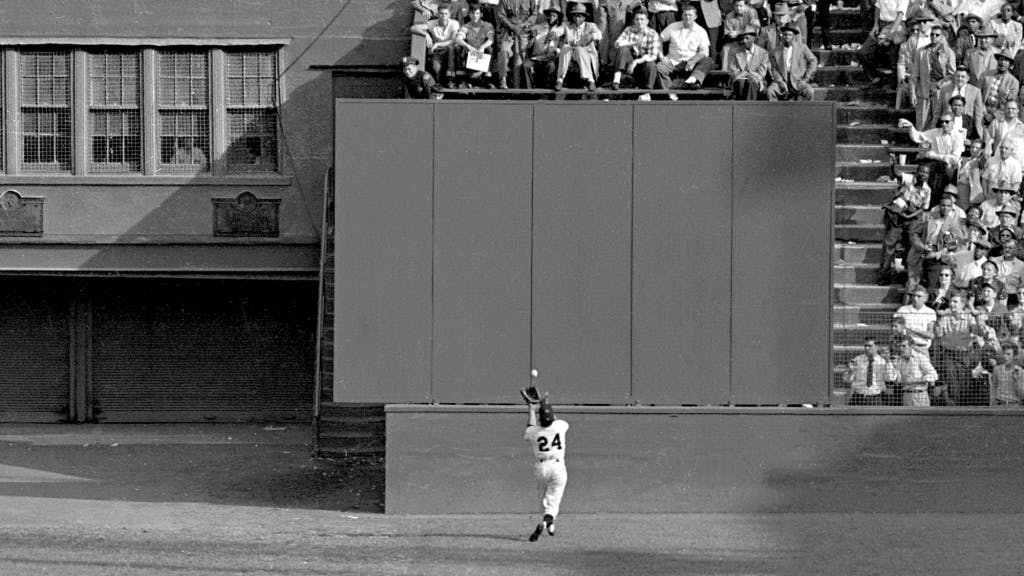

Willie Mays (Say Hey Kid)

I’ve actually got a framed print of the catch in my house.

Unbelievably, a Type 1 version of this photo sold for $1,250 a couple years ago.

Willie Mays was the greatest center fielder to ever play the game, and he routinely makes top five lists alongside Babe Ruth, Ted Williams, and Hank Aaron.

Hey may one day be eclipsed by Mike Trout, but not yet.

Inferred Value – [Insiders Only]

This is a completely new asset class for fractional investors, and frankly no one agrees what anything here is worth. Because Type 1 photos are so rare, it’s also exceedingly difficult to compare one to another. All of which is to say I’m sorry if this leaves you wanting more.

Here are some data points:

- This photo sold at auction for $31.2k.

- A Type 1 photo of Lou Gehrig’s farewell speech went for the same price

- Joe Dimaggio’s rookie photo sold for $10k

- Photos used to create Jackie Robinson’s rookie card and 1949 card went for $360k and $204k, respectively

- The photo used for Mickey Mantle’s 1951 Bowman rookie sold for $71k

- Roberto Clemente’s rookie photo sold for $3,600.

- The Type 1 photo for the Willie Mays Berk Ross rookie card is available here for $15k.

- The photo used for the 1954 Topps Willie Mays card sold for $1,500, though that was in 2018.

You can see more sold Type 1 photos here if you’d like to get a feel for them.

All of which is to say [Insiders Only].

Category Strength

The sports memorabilia category has returned 62.6% ROI so far across the entire portfolio.

Subcategory Strength

The baseball memorabilia subcategory has returned [Insiders Only] ROI so far across the entire portfolio

Risk Profile

Standard deviation for all baseball memorabilia transactions has been [Insiders Only], which is [Insiders Only]. Lower is better.

Recent Growth Trend

Based on the price of photos from a couple years ago, it looks like this asset category has appreciated [Insiders Only].

Growth Outlook and Future Catalysts

We’re looking at relatively unknown assets trading for a small fraction of their secondary products (the rookie cards). If they appreciate to anywhere near the value of the cards themselves, these photos could run a long way.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade weekly.

Platform Risk

Collectable is [Insiders Only] transparent

Intangibles

Did I mention I own a photo of the catch? But seriously, the consigner of this photo is retaining 47% of the equity, which means they will retain full control of the asset. That’s bad, in my opinion.

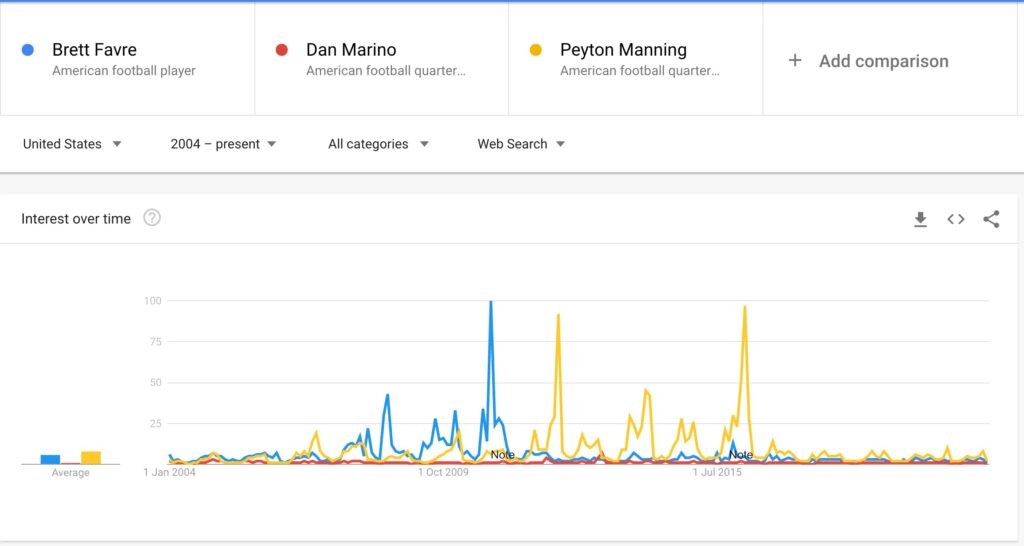

What is the Manning, Favre, Marino signed game worn jerseys?

This is a basket of game worn autographed jerseys from three Hall of Fame quarterbacks:

- Peyton Manning

- Brett Favre

- Dan Marino

Cultural Relevance

Between these three players, we three Super Bowl rings, nine MVPs, and two outstanding roles in legendary comedies.

The three players were all excellent quarterbacks who had the unfortunate luck to match up against either / both the 49ers and Patriots in the teams’ respective primes. All three rank in the NFL’s official top 25 of all time:

- Favre – 12th

- Marino – 7th

- Manning – 3rd

Brady and Montana are first and second, respectively.

All three retain some popularity despite having retired years ago, though none have the juice they once did.

Inferred Value – [Insiders Only]

All three of these players have had signed game worn jerseys sold at auction relatively recently.

- Brett Favre: [Insiders Only]

- Eli Manning: [Insiders Only]

- Dan Marino: [Insiders Only]

That gives us an inferred value around [Insiders Only]

Category Strength

The sports memorabilia category has returned 62.6% ROI so far across the entire portfolio.

Subcategory Strength

There haven’t been any football memorabilia items to trade yet.

Risk Profile

There haven’t been any football memorabilia items to trade yet.

Recent Growth Trend

This seems pretty flat actually. Perhaps up a bit.

Growth Outlook and Future Catalysts

They’ve all been inducted into the HOF already, so no catalysts on the horizon. Manning will probably [Insiders Only]

Asset Liquidity

This will have a roughly 90 day lockup period then will trade weekly.

Platform Risk

Collectable is [Insiders Only] transparent and well-capitalised.

Intangibles

I very much enjoyed Super Bowl 19. Again, though, the seller is retaining lots of equity (52%).

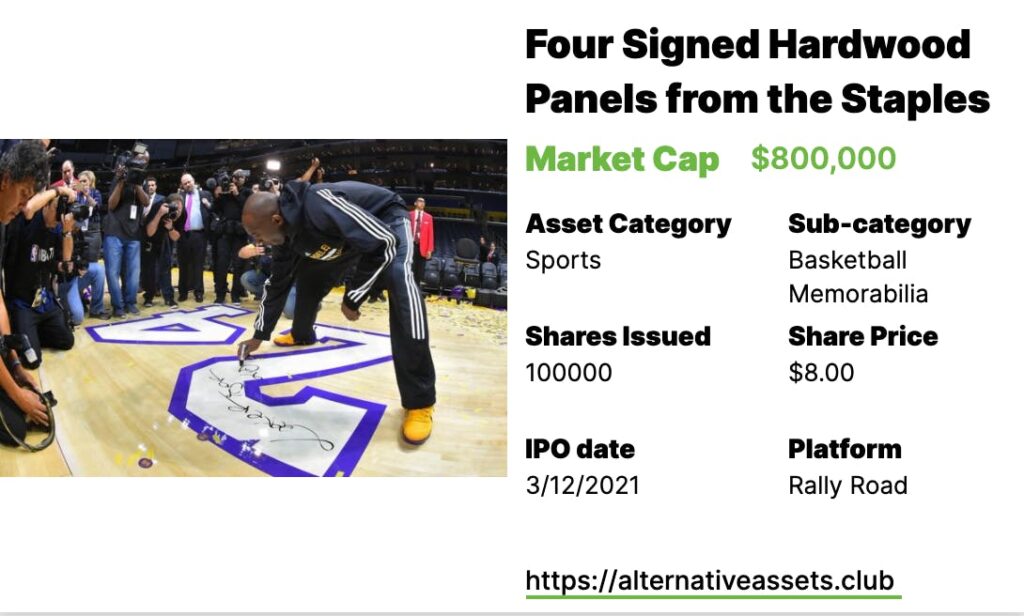

What is the asset Four Signed Hardwood Panels from the Staples Center Basketball Court used during Kobe Bryant’s Farewell Game?

Does what it says on the tin! This is four quite large hardwood panels extracted from the floor of the Staples Centre subsequent to Kobe’s final game there. He’s signed them.

It IPOs on Rally 12th March.

Cultural Relevance

One of the greatest players of all time, Bryant helped the Lakers win five NBA championships, and was an 18-time All-Star, a 15-time member of the All-NBA Team, a 12-time member of the All-Defensive Team, the 2008 NBA Most Valuable Player (MVP), and a two-time NBA Finals MVP. Bryant also led the NBA in scoring twice, and ranks fourth on the league’s all-time regular season scoring and all-time postseason scoring lists.

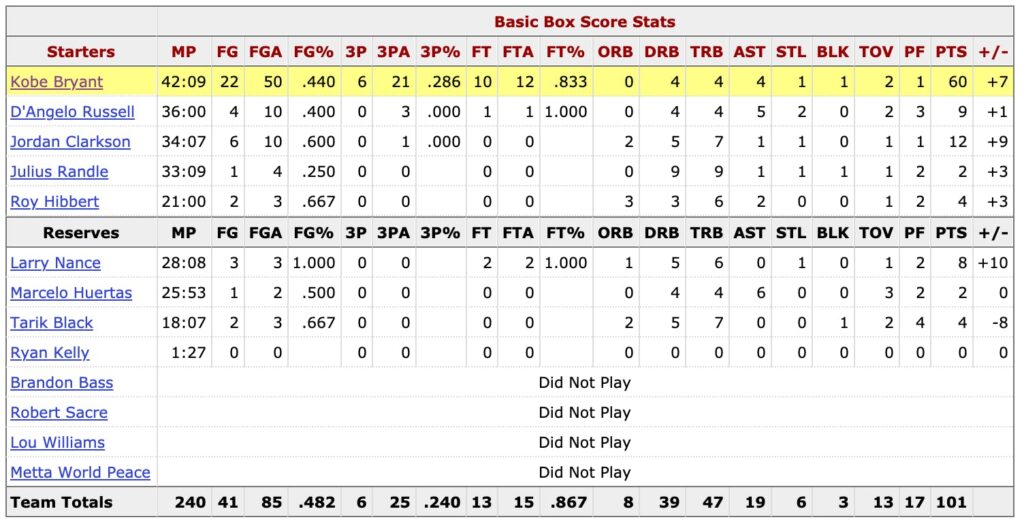

While the season was awful for the Lakers, Kobe’s final game held some redemption. Kobe fired off 50 field goal attempts, sinking 22 of them for 60 total points on the evening. It was basically “Give the ball to Kobe on his last night and let him score” for 48 minutes.

Bryant spent his entire 20 year career with the same team, which is unheard of.

Kobe Bryant, his daughter, the pilot, and six other passengers passed away in January 2020 when his helicopter crashed due to heavy fog.

Inferred Value – $631k

Rally purchased the floor for $631k via Heritage auctions last autumn, which does make the $800k market feel a bit dear.

There aren’t really any sort of comps for this. If you think it’s worth $800k, then it is. For me, I’d value it at [Insiders Only]

Category Strength

The sports memorabilia category has returned 62.6% ROI so far across the entire portfolio.

Subcategory Strength

The basketball memorabilia subcategory has returned [Insiders Only] ROI so far across the entire portfolio

Risk Profile

Standard deviation for all NBA basketball transactions has been [Insiders Only]. Lower is better.

Recent Growth Trend

Kobe Bryant gear has increased [Insiders Only] since his passing.

Growth Outlook and Future Catalysts

Not sure of any significant catalysts here. That said, this could easily be subject to a buyout offer from some rich Angelino.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade quarterly

Platform Risk

Rally is [Insiders Only] transparent and well-capitalised.

Intangibles

This is a real one of a kind sort of thing, and Rally has been promoting it like crazy. It’ll go quickly barring a silly-low share cap.

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and run Flippa’s Due Diligence program, and can offer the same service to you.See Due Diligence Packages

Facebook Group

Our Facebook Group is also now live. Request to join and we’ll let you right in.

Subscription Options

Start a Seven Day Free Trial

To unlock the full newsletter, try Insider free for a week.