Welcome to the Sports Memorabilia Insider – FREE VERSION.

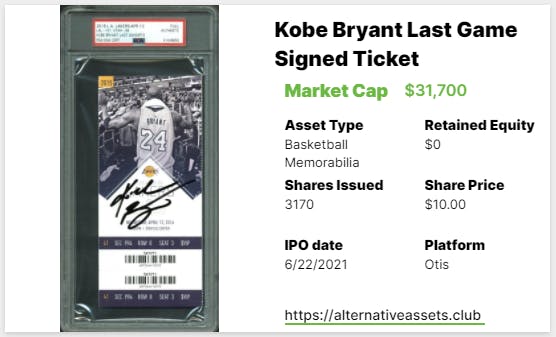

Today we have a deep dive into a Kobe Bryant Signed Ticket Stub that is IPOing on Otis Tuesday, June 22nd at 12 PM EST.

Follow me on Twitter for my latest insights and analysis.

Table of Contents

About the Asset

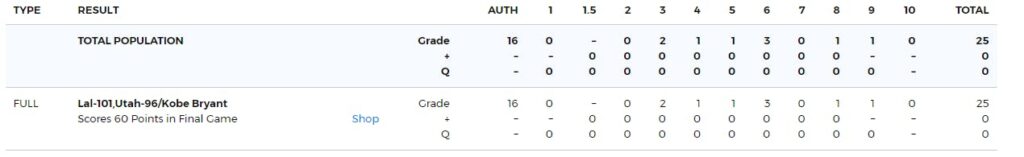

This is a signed, full game ticket from Kobe Bryant’s final game – where he scored 60 points against the Utah Jazz on April 13th, 2016. It is graded a PSA 3 / Authentic and Otis purchased it for $30,100 on March 29th. The data in Otis’ app is out of date — there are now 7 higher graded signed tickets, not 4, and I would expect more to pop up eventually.

If you were signed up to Insider (start a free trial), you’d also learn:

- Projected future growth

- Asset class ROI, volatility and risk statistics

- Detailed valuation with recent sales

- Our verdict

About the Drop

This asset will drop on Otis at 12 PM EST on June 22nd for $31,700 but it is currently available in a VIP pre-sale. There is no retained equity. Otis has been scheduling their assets for trading around 30-60 days after the IPO funds and from that point it trades every day, weekends included.

Add IPO to calendar

About Kobe Bryant

We’ve written about Kobe a bunch here. The most detailed write-up was here. I recently wrote this when his sneakers dropped earlier this month:

“But you know who he is – a transcendent cultural figure whose tragic death has led to his memorabilia being even more desirable. I suspect that over the next generation, it’s going to be Jordan, LeBron and Kobe that stand above everyone else.”

Recent Sales and Current Valuation

Inferred Value – $10K-$30K

[Detailed Valuation for Insiders Only]

Category Strength

The sports memorabilia category had a -8% ROI in Q1 2021.

Subcategory Strength

Growth Potential and Future Catalysts

The ticket stub market is an emerging and intriguing one and demand for specific games like this one could rise rapidly. With that, though, will be a flood to the market of similar items from people who have also saved them – the difference with this specific asset is that it’s signed, and unfortunately, there’s not going to be any more supply of Kobe-signed items. Despite the recent downwards trajectory, there is potential for rapid growth here.