In perhaps the most hilarious case of “putting the wrong date in the wrong place” yet, today’s analysis of the two Curry RPAs (one each on Rally and Collectable) showed the Rally RPA IPO’ing today.

It, of course, IPO’ed weeks ago.

We even wrote about it!

Between three very small children depriving me of sleep and a new database tool, we’ve now written about the Rally IPO card twice.

Hopefully the analysis is useful once they both begin trading alongside each other in a few months.

Please find below a corrected report referring to the Rally card in the past tense.

Table of Contents

What is the Stephen Curry 2009 Panini RPA BGS 9.5?

The Panini NT set Stephen Curry rookie card is his rarest and most valuable. The /99 run is only beat by a couple other parallels from the same set.

Featuring a patch of uniform and signature, it’s aesthetically pleasing, and Curry is wearing his Warriors uniform in this card unlike some other rookie cards featuring him in a Davidson jersey (his university).

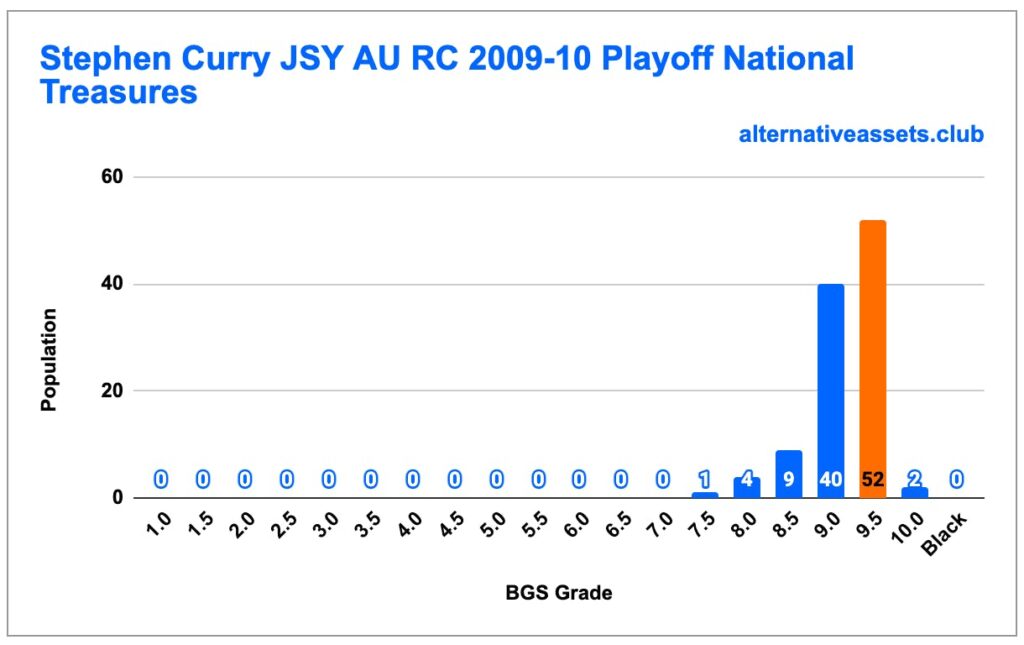

The card is graded BGS 9.5, and that’s the most common grade by far. Worth noting there are 108 cards registered with BGS and another 10 with PSA, so there’s been a fair amount of resubmissions and double-counting. So take the chart above with a grain of salt.

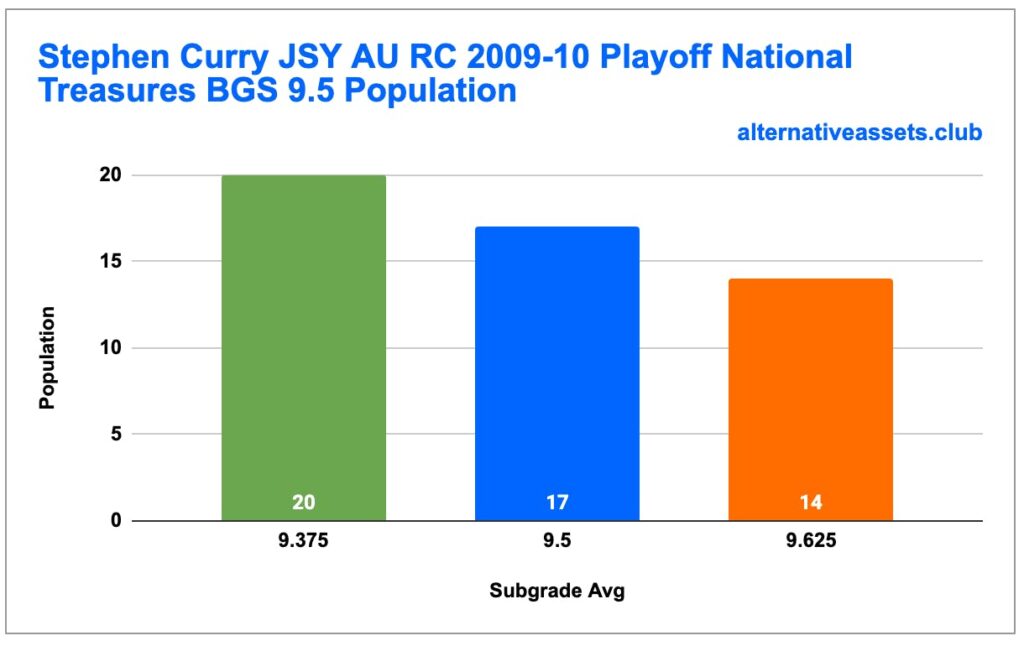

But because every BGS 9.5 has four component subgrades, there are important distinctions to make within that population. Averaging out those four subgrades gives us three possible results – 9.375, 9.5, and 9.625.

And this is how that population looks.

The card IPO’ing with Collectable is at the top end of the BGS 9.5 spectrum while the one with Rally a few weeks ago was at the bottom. That’s significant, and I’ll address that in the valuation below.

Finally, if you’d like to read the bear case for these NT RPA cards generally, have a look here.

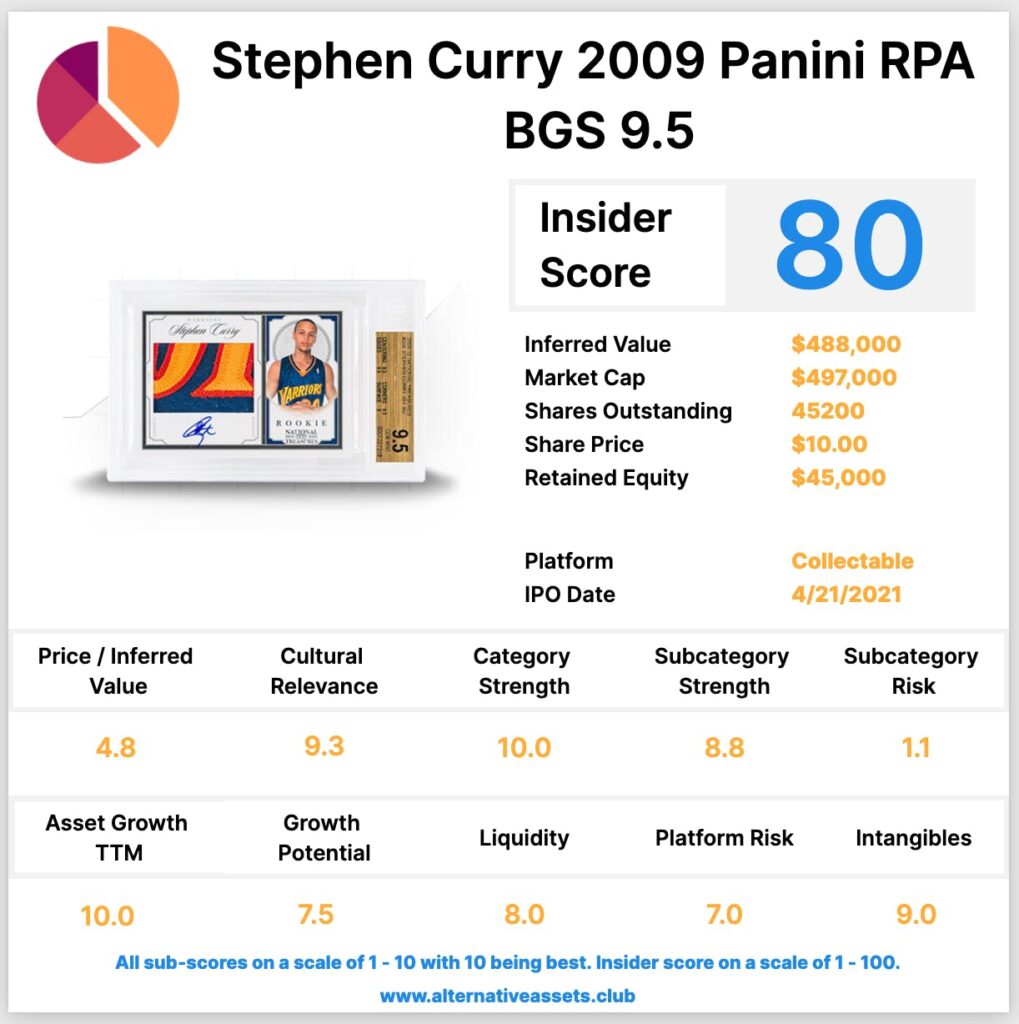

The card with Collectable IPOs at 8pm EST 21st April 2021 for $497k with $45k retained equity (9.05%)

Add Collectable IPO to calendar

Cultural Relevance

Stephen Curry is the best pure shooter in the history of the NBA. Read more about him in a previous write up here.

Points – 9.5/10

Inferred Value

Let’s have a look at recent sales of both BGS 9.5 and BGS 9.0 cards to get a feel for the market.

BGS 9.5

- April 7 2021 – $192k (can eliminate this as a comp due to the appalling signature)

- February 1 2021 – $451k with 9.375 subgrades (Goldin) (Rally’s Purchase)

- July 23 2020 – $82k (9.5) (eBay)

- April 16 2020 – $55k (9.5) (eBay)

BGS 9.0

- March 8 2021 – $369k (9.125) Goldin

- February 1 2021 – $337k (9.125) Goldin

- February 3 2020 – $12k (9.125) eBay

There was also a PSA 9 sold at Goldin for $420k 7th March 2021.

As far as I know,there aren’t any of these cards currently at auction.

So as you can see from the two sales on February 1 at Goldin, the difference between a 9.5 and a 9.0 can be relatively small if the subgrades are very close to each other. And we can actually use that difference to infer the value of each bump up in subgrade.

This is how I’ll do that:

First, modify the price of that BGS 9.5 down by 10% to account for the fractional premium. It’s now $406k.

So a quarter grade difference in value can be inferred as $406k – $337k, or $69k.

But there’s no doubt there’s a value to a card showing a 9.5 rather than a 9.0. Similar to the PWCC’s eye appeal scale, we need to factor that in. This is more art than science, but let’s say that of that $69k difference above, $50k is due to the 1/4 grade difference, and the rest is due to the 9.5 v 9.0.

So each quarter grade is worth perhaps $50k, and that should be the valuation difference between these two cards. The one with Collectable should be valued $50k higher than the one Rally IPO’ed a few weeks ago.

So what is the one with Rally worth today?

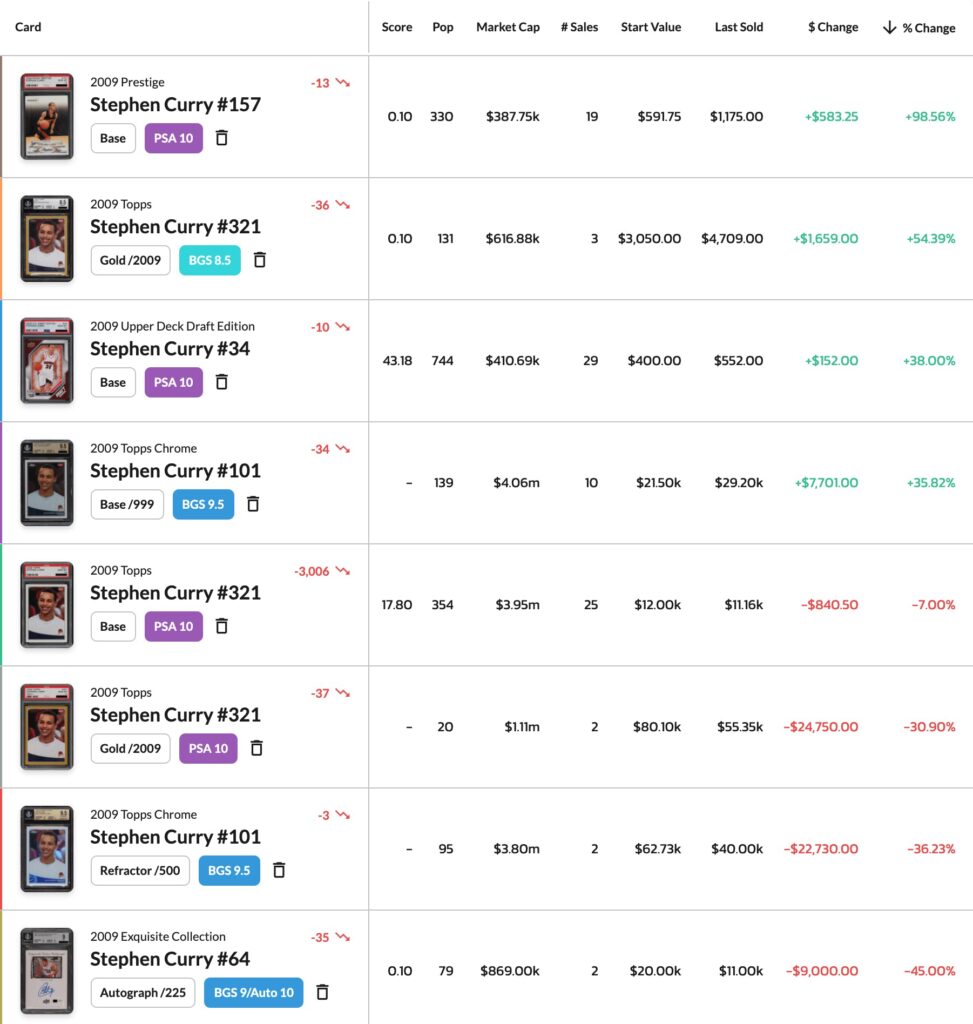

Easiest thing to do is to take the most recent sale ($406k February 1 2021) and adjust that for how a basket of Curry’s more expensive cards cards have done since then.

All in all, a pretty mixed bag but an 8% increase since February 1 2021.

That values the card from Rally at around $438k and therefore the card from Collectable at $488k.

It’s worth noting the Rally card still hasn’t fully funded.

It’s also worth noting that CardLadder has used a four year price history comparing five BGS 9.5 sales to his base rookie card and has come up with a 52x multiple. That would value a midline (9.5) card at $588k. Therefore, the Rally card should be valued at $563k, and the Collectable one at $613k.

I think that’s flawed, though, because their multiples over five years were all over the place (27x, 39x, 74x, 83x, and 41x), and they don’t account for the variance within the subgrades.

Even though I think it’s wrong, I thought it was important to share.

Points 10/10

Category Strength

The sports cards category returned a 60% ROI in Q1 2021.

Points 10/10

Subcategory Strength

Basketball cards returned a 58% ROI in Q1 2021.

Points 9/10

Risk Profile

Basketball cards have returned an 89% standard deviation. Lower is better.

Points 1/10

Recent Growth Trend

Curry’s base rookie card has appreciated around 750% in the last twelve months.

Points 10/10

Growth Outlook and Future Catalysts

Can Curry win another championship or two to vault him into the all-time greats? That’s what this all hinges on.

Points 8/10

Asset Liquidity

This will have a roughly 90 day lockup period then will trade daily.

Points 8/10

Platform Risk

Collectable is moderately transparent

Points 7/10

Intangibles

Retained equity is low enough not to be an issue, so these can get the same intangibles score. This is the most prized rookie for the best shooter in NBA history, which bumps it up for me.

Points 9/10

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and run Flippa’s Due Diligence program, and can offer the same service to you.

Enquire about Due Diligence Packages

Facebook Group

Our Facebook Group is also now live. Request to join and we’ll let you right in.