Today we’re looking at vintage vinyl — an asset class I’ve been looking forward to researching for months.

Perhaps it’s because I’ve been listening more closely, but to me, the drumbeat around vinyl is getting louder. I brought this up in a recent IG Live interview, and audience members seemed to agree.

Professional musicians are also starting to take notice, as this clip from Steve Aoki can attest:

In this issue, we’ll look at how vinyl rose, fell, and then rose up again — and what the future holds for this extra-special asset class.

Let’s go

Table of Contents

A short history of music distribution

To understand what makes vinyl valuable, it’s good to know where it came from.

Vinyl was born out of the recorded music boom of the early 1900s. The phonograph and gramophone were the first devices to play recorded music. The oversized black discs we all recognize started in this era. Music was literally etched into tinfoil, and later wax.

The world used these for decades. But playtime maxed out at just 3.5 minutes, and the discs were expensive to produce. In 1948, Columbia Records introduced the first record made of polyvinyl. It used microgroove plastic to extend playtime to 21 minutes per side.

But vinyl records were bulky and fragile. So the music industry searched for a new way to share recordings. In the 1960s, Philips created the cassette tape.

Cassettes sacrificed the fidelity of vinyl in exchange for portability and convenience. They sounded like garbage and were a pain when the magnetic tape got tangled, but who cares?! For the first time ever, you could listen to music while walking around!

What’s really interesting about cassettes is that they introduced the concept of music piracy — a theme that has defined the industry ever since. People could simply use tape recorders to save music off the radio (or their vinyl) and distribute them. More on this later.

After a brief pit-stop at 8-track cassettes, the music industry took another revolutionary turn. The compact disc was pioneered by Sony and Philips, in the 1980s. Here’s the first TV ad for a compact disc:

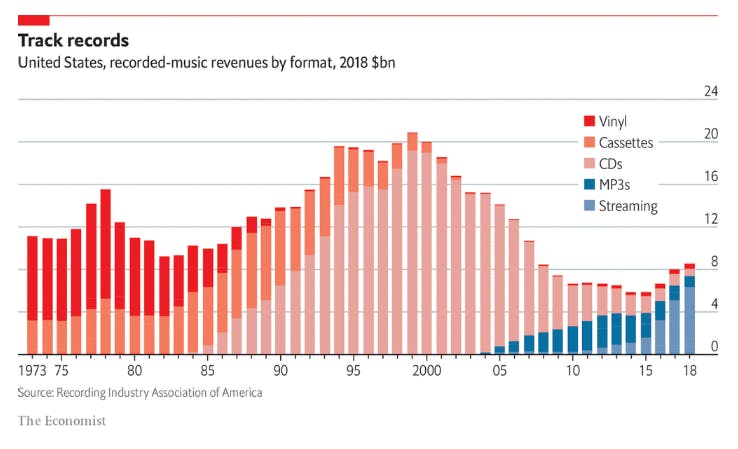

CDs combined the high audio quality of vinyl with the versatility of cassette tapes. They could be used in CD players, computers, and cars. They quickly surpassed vinyl in popularity; by the mid-80s, vinyl sales were falling off a cliff.

Yet once again, the issue of piracy persisted. People could easily purchase blank CDs and ‘rip’ entire albums onto them, getting their favorite music for free.

CDs’ reign of dominance lasted 20 years, until MP3s came storming in. MP3s took convenience and portability to a whole new level – you could listen to these digital files practically anywhere. They could be played, easily stored, or sent over the Internet. It gave music buffs a whole new way of organizing and collecting music.

However, the MP3 area was littered with controversy around, you guessed it, piracy. The famous case of Metallica vs Napster in 2000 was a landmark copyright infringement lawsuit that made headlines around the globe.

(Side note: I’ll never forget the day I logged into Napster and saw an error message saying, “Your account has been terminated due to Metallica.” I wish had a screenshot. It would make an epic NFT.)

Metallica won the case and Napster eventually shut down. But the genie was out of the bottle. Torrents continued to push piracy mainstream, until finally the industry gave up. They ultimately decided to just give people unlimited music, but make them pay for it.

This proved to be a recipe for success. Streaming quickly overtook all other forms of music consumption, and is now the music industry’s biggest revenue driver.

Why vinyl?

So, what does any of this have to do with vinyl?

Well, let’s look at the common issue faced by all music mediums up until the streaming era.

It’s piracy. CDs, cassettes, and MP3s were all easily replicated, which depressed their intrinsic value. How much can something be worth when it can be mass-produced so cheaply? (NFTs are a whole other story.)

While someone could technically pirate a vinyl record (psst – here’s how) it can be just as expensive as buying the real thing.

Vinyl is the last frontier of musical integrity. It’s nearly impossible to replicate, and so the value of a vinyl record is much easier to define.

But it’s more than that. As we’ve discussed in investing in music rights, vinyl is on the upswing.

Let’s dive into why people are buying vinyl again, and why they make a good investment.

Vinyl has the best hi-fidelity sound

CDs and MP3s were intended to be the vinyl-slayer — higher-quality music in a more convenient form. Yet, many people actually prefer the sound of records. The reason is due to compression.

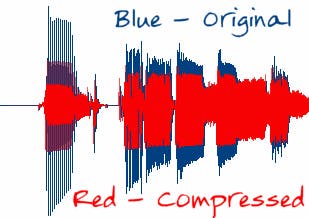

Compression is a way of manipulating audio to reduce file size, where the sound wave is literally compressed. This is done by ‘squashing’ the volume of loud sounds, and amplifying the volume of quieter sounds.

This is an important part of music production, as songs with extreme peaks and valleys can sound inconsistent. It also means streaming takes up less bandwidth, which makes production cheaper.

However, compression removes the depth and nuance from a song. It’s almost like we’ve gone too far towards the cheap side.

Vinyl, on the other hand, is both incredibly nuanced and riddled with imperfections. Pops, scratches, and a discernible white noise are all part of the listening experience. Listening to vinyl feels organic, warmer, and closer to attending a live show than anything else.

Vinyl is more physically appealing

Don’t get me wrong, there are some beautiful CDs with great artwork and fun little easter eggs. But generally speaking, they don’t compare to vinyl.

Vinyl records are big, and the artwork is a hugely important part of what makes it so cool. There is so much fun stuff artists can do with the packaging, since not everything has to be crammed into a tiny square box.

Vinyl also looks great on display, which is important for collectors. It’s become quite popular to buy vinyl frames, which make for awesome wall art, and there are tons of other cool vinyl gift ideas.

Scarcity

New vinyl records are still being pressed today. While contemporary vinyl presents a less compelling investment opportunity, vintage vinyl is another story.

Older records or special releases often have a very limited circulating supply and can be highly sought-after. Take any Beatles album for example. Getting your hands on a first-pressing costs over $100.

The value of older, out-of-circulation albums increases when only a small number of records (<1,000) were originally pressed. Special edition records occasionally come marked with a serial number, much like you see with modern-day NFTs. Records with a lower number (like 1-10) are worth a lot more than higher ones.

Most expensive vinyl records ever sold

John Lennon and Yoko Ono — Double Fantasy

Though vinyl has only really soared back into popularity the past few years, it has been a prominent collector’s item for decades.

One example is John Lennon and Yoko Ono’s album Double Fantasy. A signed record sold for $150,000 in 1999, and it’s easy to see why. The album was signed by Lennon himself on the 8th of December, 1980. This also happened to be the day that he was murdered — meaning it was one of the last signatures he ever parted with.

Even more astonishing? The signature is addressed to none other than Mark David Chapman – the man who killed him!

A bit creepy, yes. But in 2020 the record was re-listed at auction, and sold for $900,000.

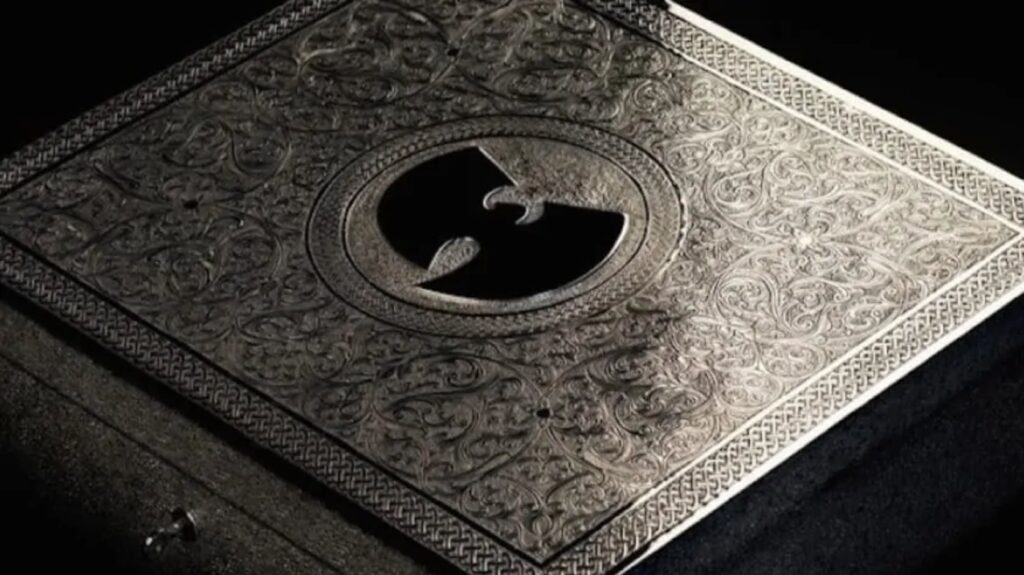

Wu-Tang Clan — Once Upon a Time in Shaolin

However, the most expensive vinyl ever sold was by hip-hop legends Wu-Tang Clan. Their 2015 release Once Upon a Time in Shaolin raked in a whopping $2 million.

Why was it so expensive? It was the only copy of the record ever made.

The lead of the Wu-Tang Clan, RZA, and album producer Cilvaringz originally created the album in response to their concerns that piracy and digital streaming cheapens the value of music. Cilvaringz said they hoped that the album would “return music to the value of fine art.”

The buyer was notorious pharmacist Martin Shkreli, who infamously hiked the price of a life-saving HIV pill from $13.50 to $750 per pill.

He had to sign a contract agreeing not to sell or profit off the album for 100 years (though it could be shared publicly). The contract became moot, however, when Shkreli was convicted of fraud and had to sell the asset to pay his fines.

The record was eventually purchased by PleasrDAO, who just a few weeks ago, minted an NFT as a way of distributing fractional ownership of the record among the members.

The Beatles (White Album)

The Beatles serialized the vinyl release of their 1968 double-album, with the very first number being ‘0000001’.

This edition of the record was held by none other than Ringo Starr, who sold the record at a 2015 auction for $790,000.

The Beatles will further make history when its first record, ‘Love Me Do,’ becomes the first publicly fractionalized vinyl on Rally. Now, a group of Beatles fans, music enthusiasts, and investors can own a piece of one of the music industry’s iconic records. (We’ve analyzed this offering below)

What makes a vinyl record blue-chip?

Original pressings

I know I sound like a broken record (har har!) but scarcity is everything.

If a specific edition of a record had a low pressing or sales figure, it will likely be hard to find in good condition, and therefore an appealing collector’s item.

Scarcity may be even more important than a record’s cultural panache. For example, an Elvis record from the 70s that sold millions of copies will probably be worth less than a special reissue from the 90s that only had 1,000 pressings.

That said, original pressings will most likely be the most valuable version of that album you can find (and usually the rarest).

You can often figure out if a record is a first-pressing by simply looking at the sleeve – original pressings usually have an 8-digit number/letter combination. Later pressings generally only have five digits on the sleeve.

Data on how many copies of a specific pressing are in circulation can be tricky to find, especially since newer releases intentionally obscure the data to artificially generate scarcity. Your best resource here is discogs.com.

Artist’s popularity

Prestige is a major factor. There’s no use in buying a ‘rare’ record that has two copies in circulation if only two people actually want to listen to it.

It probably won’t come as a surprise that seminal artists comprise the vast majority of the collectible record space. Though vinyl doesn’t have to come from an older artist to be valuable, the most sought-after records are generally from artists that were popular 50+ years ago.

Artists to look out for include:

- The Beatles

- The Rolling Stones

- Led Zeppelin

- The Beach Boys

- Elvis

- Queen

- The Who

- Miles Davis

- David Bowie

The same concept applies to more contemporary musicians too. The more popular and genre-defining artists will be worth more than others. Recent artists with in-demand, expensive vinyl records include:

- Wu-Tang Clan

- Radiohead

- Prince

- Aphex Twin

- Daft Punk

Special editions

Special editions are very common in the vinyl world and almost always make a record more valuable.

Usually the supply is limited, or the artwork is unique. Examples include holograms, bright colors, or even a record made from ice:

Other special editions include records that are autographed, or those that come with exclusive inserts like lyric booklets, album liner notes, or rare photographs.

In the case of Radiohead’s The King of Limbs, each vinyl record came with an actual newspaper.

With vinyl, there’s no limit to how creative artists can get. Assigning a dollar amount to each feature is impossible, but special editions are nearly always rarer and more valuable than their standard release counterparts.

Condition

Like with most collectibles, condition is directly correlated with value.

A scratched, broken record with tears in the cover artwork will be worth much less than one in pristine condition.

Sealed vinyl is in the best condition, but comes with the drawback of being unplayable. If you’re looking to invest in records from a purely financial standpoint, then sure, sealed items will maintain their value the best.

However, if you want to enjoy the music too, it might be worth buying an opened vinyl in very good condition and carefully looking after it.

Vinyl grading

This could be what’s holding vinyl back.

When talking about condition, we must always think about grading systems. Popular collectibles like trading cards have well-established grading standards through PSA and BGS.

WATA is grading video games, but the grading ecosystem for vinyl hasn’t really developed yet.

The most-used system on marketplaces like eBay and discogs is pretty close to most other collectibles. It ranges from (P) Poor, to (M) Mint. This is based on the Goldmine Grading Guide, set by the music collectibles company of the same name.

The future of vinyl

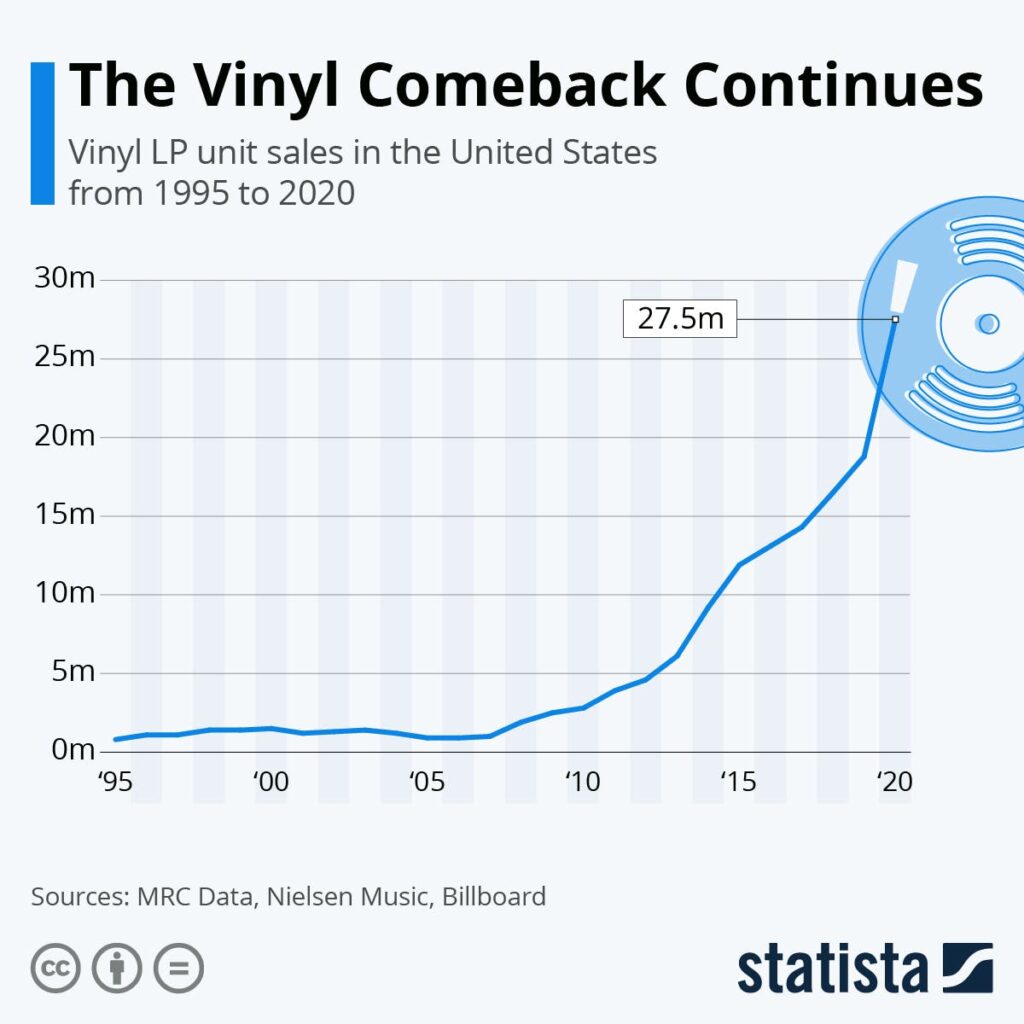

It wasn’t long ago that vinyl was left for dead, considered well on its way to becoming extinct.

However, in 2020 vinyl sales in the United States grew for the 15th straight year. 27.5 million vinyl records were sold in the US in 2020 — that’s up 46% YoY, and up 3,000% since 2006.

Yes, vinyl accounts for under 4% of total music sales. But if you think about it, even that is tremendously high. What other “dated” technology from the 1950s has this level of market share? Barbie dolls? Black & white TVs? Nothing else comes close.

Fractional vinyl opportunities

The Internet has revolutionized not just the way people consume music, but the way people invest. Thanks to fractional investing, rare and exclusive vinyl is more accessible than ever.

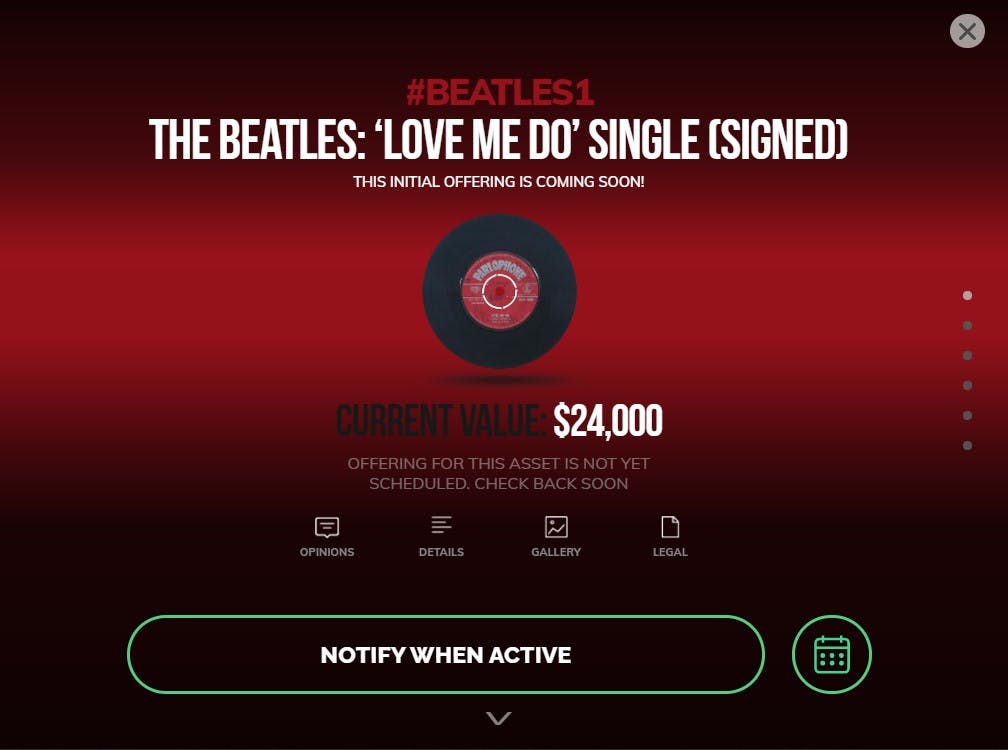

In fact, the first-ever fractional investment opportunity for vinyl is just around the corner. Rally announced they are in the process of acquiring and listing a signed release of The Beatles single ‘Love Me Do’, valued at $24,000.

The record has a recent history of doing well at different auction houses:

- The Beatles attended the official signing in 1962 at Dawson’s Music in the town of Widnes.

- In 2012, a signed copy of ‘Love Me Do’ sold for nearly $22,000 by renowned online auction house Paul Fraser Collectibles.

- A first pressing of ‘Love Me Do’ signed by all four Beatles sold for $40,000 at a Sotheby’s auction in October 2020. The auction exceeded the expected bid price of $27,000

This last sale especially is confirmation that a) Beatles memorabilia is on the rise, and b) vinyl is an emerging alternative asset class.

Conclusion

The resurgence of vinyl presents an exciting investment opportunity in a unique, special asset class.

In the past, vinyl was seen as more of a personal collectible for music buffs than a moneymaker. After all, music can be a deeply emotional and private form of art. Those vinyl records which were serious assets (signed original pressings or extremely scarce records) priced out most everyday investors.

New fractional offerings like Rally’s are big deal, as they’ll allow those without deep pockets to gain exposure to blue-chip records they otherwise wouldn’t be able to afford.

Whether vinyl will become popular with investment firms remains to be seen. But one thing’s for sure — public interest in vintage vinyl is growing.*

Despite being a 70-year old technology, vinyl is standing the test of time. Other vintage asset classes have a nostalgia factor, but the technology itself provides no improvement over existing solutions.

Take typewriters, for example. There’s a reason there’s essentially no market for used typewriters. They’re complete junk! They have all the inconvenience of being a dated technology, while offering no improvement to the user experience.

VHS tapes are another example. At the end of the day, do they really matter? Will anyone ever care again? Just because something is old doesn’t make it valuable. NES games? Sure. But VHS tapes? The quality was terrible, and they were mostly a pain in the butt. They offer absolutely nothing better than modern replacements. Plus they’re tough to show off.

Vinyl is arguably a fundamentally better way to consume music. It has higher fidelity sound, beautiful artwork, is easy to display in your home, and unlike other vintage items, it has actual, real utility.

I recommend getting your hands on blue-chip vinyl now.

Rally fractionalizing the Beatles record is a big deal. It’s only a matter of time before more opportunities like Rally’s open up. It feels like this market is about to kick into a higher gear. And once the grading ecosystem develops, the market could truly explode.

Watch this space. Keep your eyes (and ears!) wide open

*Note: In writing this piece I discovered there is no emoji for vinyl records OR record players. For shame! Help me report this crime to the emoji overlords.

We hope you enjoyed this issue! A big thanks to Ben Knight for helping with this one.

Cheers & happy investing.

— Stefan