Welcome to Sports Memorabilia Insider – FREE Version. We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

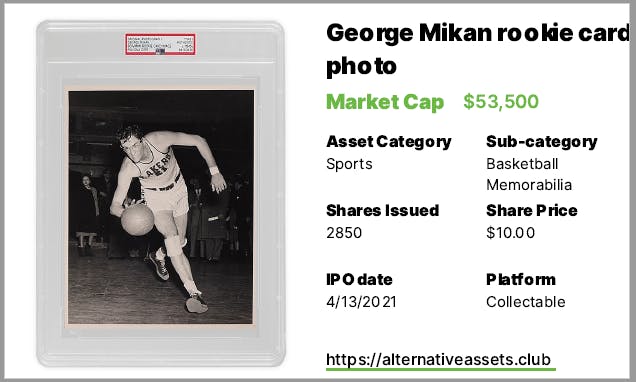

Today is a deep dive into the 1948 Bowman Rookie George Mikan Original Photo that will IPO at Collectable on April 13th, 2021 at 1 PM EST.

Follow me on Twitter for my latest insights and analysis.

Table of Contents

What is the 1948 Bowman Rookie George Mikan Original Photo?

This is is an original photograph of NBA Hall of Famer George Mikan that was used as the basis for his 1948 Bowman Rookie card.

Importantly, this is a Type I photograph, which is defined by PSA as: A 1st generation photograph, developed from the original negative, during the period (within approximately two years of when the picture was taken). Type I photographs are the originals and the most valuable.

As it was taken to be featured in the Sporting News, the exact photographer is not identified. It is signed, faintly, by Mikan, in blue ink, measures 8″ x 10″ and has been graded as Authentic by PSA. If you haven’t read this article the last couple of times we linked to it, it’s worth doing so — it’s a good overview of the nascent sports photography market.

It IPOs on Collectable at 1 PM EST on April 13th for $53,500. The consignor is holding $25,000 in retained equity, leaving $28,500 in shares.

Add IPO to calendar

Cultural Relevance

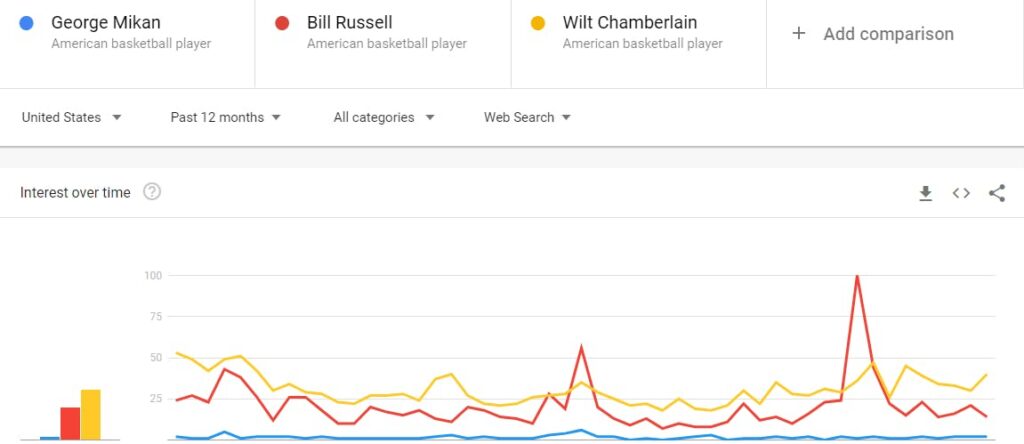

George Mikan was the original Big Man, predating the modern NBA and is considered the first true superstar in professional basketball. Without his star power in its early seasons, the NBA may never have succeeded. A member of the Minneapolis Lakers, his teams won 4 of the first 5 NBA titles (the one year they didn’t, Mikan fractured his leg), and prior to that, the Lakers won 3 straight titles in the NBA predecessors, the NBL and BAA. He was elected to the first four NBA All-Star teams, was a three-time scoring champ, was elected to the Hall of Fame in 1959 and was named of the 50 greatest players in NBA history in 1996. Before his rise, tall players were considered too uncoordinated to be effective basketball players. He was so successful that a number of rule changes had to be implemented – goaltending, for one, as he could just stand by the basket and knock the ball away before it went in. The lane was widened to lessen his dominance in the post, and he indirectly led to the implementation of a shot clock. After his career ended prematurely due to injury, he eventually became the first commissioner of the ABA, the league that introduced the 3-point line. He was also instrumental in the formation of the Minnesota Timberwolves. When Mikan died, Shaquille O’Neal paid for his funeral, saying that “Without number 99 [Mikan], there is no me.” However, because he played so long ago and well before the NBA was a national and global phenomenon, Mikan is not well known outside of fans of basketball history. You can see this from his Google search volume compared to a couple of other early-era NBA greats.

Inferred Value – $30K+

[Detailed Valuation available to Insiders Only]

Recent Growth Trend

Growth Outlook and Future Catalysts

If original photographs tied to rookie cards do become a coveted category, this one could certainly see a boost in value. It is scarce but not a 1/1 — it is very difficult to know how many other Type 1 photographs exist — I was able to track down two others (one signed, one not) besides the Collectable one and the one that sold recently at Heritage. There’s no particular reason that Mikan items will see a specific boost, however. Keep an eye on this Mikan Rookie PSA 7 auction at Heritage — a PSA 7 last sold for $31,200 in December. Where it ends in comparison to that will be very helpful in seeing where his market has gone.

Category Strength

The Sports Memorabilia category had a -8% ROI in Q12021.

Subcategory Strength

Risk Profile

Asset Liquidity

This will have a roughly 90 day lockup period then will trade daily.

Platform Risk

Intangibles

While the retained equity level is under 50%, it’s close enough that the consignor is going to have all the power on any buyout opportunities.

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and runs Flippa’s Due Diligence program, and can offer the same service to you.

Subscription Options

Start your free trial of Insider.

Deep research and investment insights, now on thirteen alternative asset classes.

Share Alternative Assets, Get Rewards

Enjoying Alternative Assets? Now you can share your personal referral link and get rewarded.

Get hoodies, tees, and other cool swag. When someone signs up through your link, your referral count goes up.

It’s a generous program. Rewards start at just 2 referrals!

- Your referral count: [RH TOTREF GOES HERE]

It’s easy. Click the button below to access your rewards hub:

Or copy & paste your referral link here: [RH REFLINK GOES HERE]

Share on Twitter | Share on Facebook | Share via email

Thanks for spreading the word!