(Note: This is Part 1 in our series on RAD Diversified. Here’s Part 2: RADD America Review: The allure of land REITs)

Today, we’ll be taking a look at diversified REITs, a form of real estate investment that we’ve briefly touched upon in the past.

We’ll also be exploring RAD Diversified, a business that offers both accredited & non-accredited investors the opportunity to grow their portfolios through select real estate acquisitions.

RAD is a current sponsor of ours, and we’ve been getting some questions about their service. So we decided to dive deep and find out more.

Today’s issue is written by Ben Knight, who previously wrote about fractional real estate investing.

Let’s go

Table of Contents

Why real estate?

There’s a well-known saying among millionaires: 90% of the world’s millionaires were created by investing in real estate.

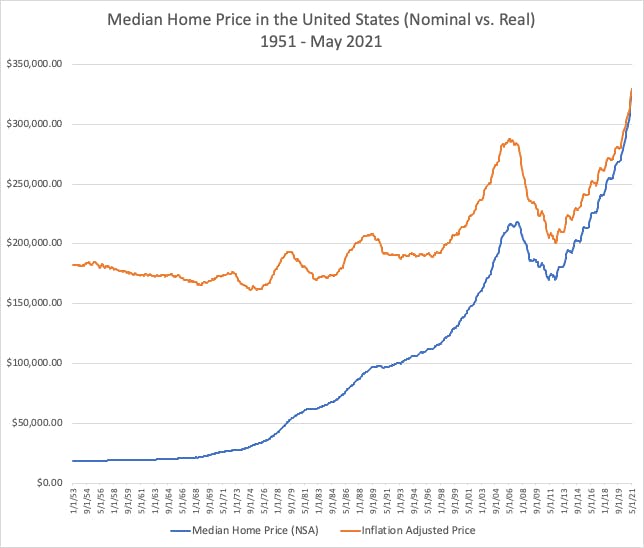

Real estate has been one of the most popular investment options for hundreds of years, and it’s easy to understand why — having a nice place to live will never go out of fashion.“Buy land. They ain’t making any more of the stuff.” -Will Rogers

In the long run, real estate is just about as rock-solid of an investment as it gets. There’s a reason the word REAL is in the name.

But climbing the property ladder has become increasingly impossible for many, leading to some unfortunate social consequences, as illustrated by this tweet:

What is a REIT?

REIT stands for Real Estate Investment Trust. REITs are publicly traded funds that are similar to an ETF. They can be traded or be exchanged like any other stock, earn dividends, and appreciate over time.

REITs are essentially an index fund of a basket of real estate. A corporate management team selects investment properties based on a thesis, and securitizes them into a single offering. These funds often comprise of dozens or hundreds of different properties.

Investing in a REIT is the easiest way to gain real estate exposure without leverage. REITs give investors real estate exposure without needing to worry about huge down payments, mortgages, tenants, maintenance, or interest rates.

They are also far more liquid than physical real estate. If you need to raise funds quickly, it’s a lot easier (and cheaper) to sell your real estate stocks than to sell physical property.

Perhaps the best part of investing in a REIT is that a management team does all the work for you. And while it’s been pretty tough to lose money on real estate over the past 5 years, fund managers are doing a good job. According to the MSCI U.S. REIT Index, since 2016 the average annualized return of REITs in the United States was 7.58%.

Diversified REITs

Diversified REITs are slightly different from typical REITs. While REITs tend to stick to the same type of properties — like tax deeds, residential homes, and income-producing farms, diversified REITs expand their horizons, giving investors exposure to a broader range of properties.

For example, a diversified REIT collection may include:

- Multi-family units (i.e. apartment buildings)

- Residential luxury condos

- Vacation rentals

- Walkable commercial (shops & cafes in high-density locations)

- Industrial (warehouses)

- Cell towers

- Data centers

- Malls

- Hotels

- Raw land

- Working farms

- etc.

The benefit of this is pretty clear — investors can hedge their bets. If a particular sector of the real estate market nosedives, fund managers can mitigate the damage by holding a portion of their holdings in a different sector.

RAD Diversified

RAD Diversified was founded by Dutch Mendenhall, who was joined in 2011 by Amy Vaughn. Based in Los Angeles, they currently have a team of 30+ managing a huge variety of real estate assets.

RAD was created due to a lack of helpful information about existing real estate options. While everyone hears stuff like, “invest in this area, it’s gonna blow up!”, or “you should buy a property and rent it out while you’re young!” the advice is often ambiguous and irrelevant, from people who have no idea what they’re talking about.

Early in his career, Dutch worked in commercial banking and real estate, where he gained exposure to the nuts & bolts of the industry. Using his experience, he founded a real estate education company. His goal was to mentor folks without access to professional real estate advice, and to share everything he had learned.

With a specialty is in Tax Sales, Dutch also has a survivalist streak. Here he is on the Invest Like a Boss podcast, discussing emergency plans, future growth in the survivalist segment and how it all ties into RAD’s investment strategy.

It was actually his students who were the catalyst for creating RAD. They were pretty enamored with Dutch’s knowledge and ideas. But he realized they didn’t want to just apply their learnings to the current market, they wanted to personally invest with Dutch.

To capitalize on this opportunity, Dutch put together a fund that they could invest in. What started as just one fund, grew into two, then three…

What does the RAD Diversified REIT do?

After his 4th fund, the business began a rapid evolution. Dutch was getting positive feedback and strong returns on his initial offerings, so he decided to share this success with as many people as possible. The evolution became the RAD Diversified REIT.

RAD gives exposure to residential homes, multi-family properties, and income producing farms in key real estate markets across the U.S. The REIT also utilizes innovative techniques of the foreclosure market. RAD also renovates dilapidated housing stock into attractive, livable real estate.

They are a trusted, SEC-qualified company, boasting an excellent 33.5% return over the past 12 months. Keep in mind real estate funds typically return under 10% YoY. So 30%+ is very good.

The addition of income-producing farms – an often overlooked investment opportunity – was a large part of the fund’s strong recent returns, boosting the typical annual figures by an additional 10%.

How does it actually work?

While these numbers are impressive, it’s never a good idea to invest in something without understanding how it works.

RAD Diversified is a Reg A+ Offering which sell common shares (currently $16.39, up from $10)

Starting with a minimum investment of $1,000, investors gain access to a proportionate number of shares in their REIT — essentially making them a fractional owner of RAD Diversified’s portfolio of properties.

From this point, money is distributed like dividends, although they are only accessible every 6 months (in July and January). These returns come from rent collections across the board, regardless if the client is from a residential, commercial or income property.

On top of this, investors gain exposure to capital gains in value and equity within the property portfolio.

What makes RAD Diversified unique?

One of the key drivers for RAD Diversified even being formed was dissatisfaction with the current state of REITs and other real estate funds in the US. While some REITs excel at technology and others at raising capital, they are often bogged down in old skill sets and antiquated methods.

RAD Diversified’s founders realized other funds they weren’t maximizing their ability to buy and sell in alternative ways, like off-market and under-market real estate.

Alternative investment methods

The way that RAD Diversified assesses and finds property poses a point of difference to other REITs. They use artificial intelligence paired with location-specific research to analyze trends to advance their portfolio.

The key selling point for RAD’s portfolio is their ability to use multiple channels to purchase properties well below market value. By exploring all potential avenues for real estate investment, the RAD team is able to source interesting opportunities other companies may gloss over.

This has a clear advantage. Like they say in real estate (and as I discussed in Anatomy of a Deal) you don’t make money when you sell, you make money when you buy. The better the purchase price, the better the returns.

Diversification

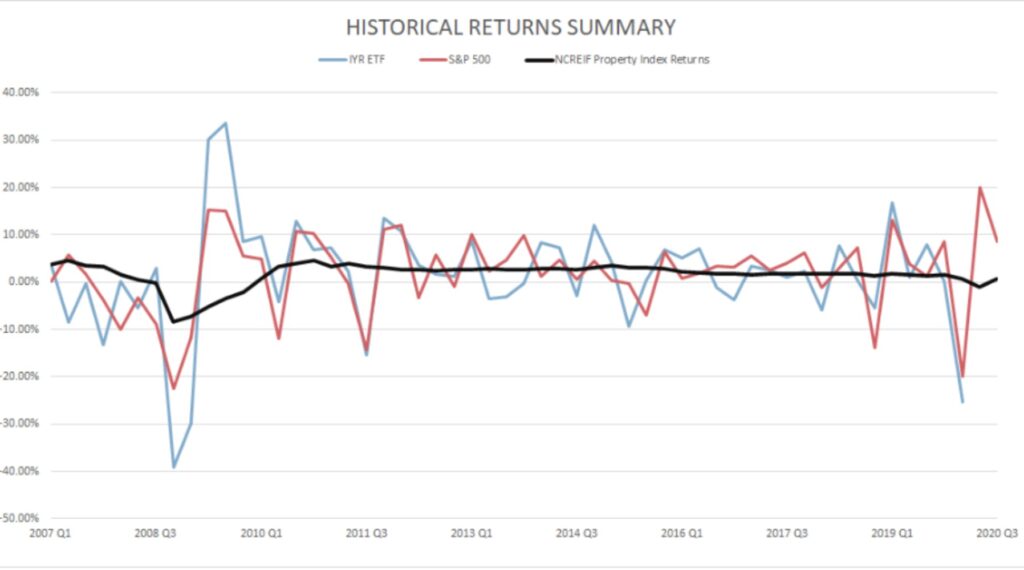

What makes RAD Diversified unique relative to their competitors is that they are not publicly traded. This was done for one main reason — to avoid having stock market fluctuations affect the price of the REIT. To Dutch, it’s important that no politician or outspoken billionaire can affect RAD’s fund value.

The REIT solely tracks the net asset value (NAV) and gains of RAD Diversified’s portfolio, not the presidential election, trade conflict or other discourses that can negatively impact other investments.

Diversification is the name of the game for many investors, and it is something that RAD Diversified prioritizes. (It is part of their name, after all).

Relationship with investors

RAD places a strong emphasis on its relationship with investors. Having started as an education service, the business is naturally experienced in client communication.

They conduct a monthly Zoom call — sort of like an “office hours” for all investors, who are able to raise questions and get regular updates on additions to the portfolio. To ensure a personal touch, they prefer to do this face-to-face rather than via email.

Finally, they also regularly provide tax advice for investors, no matter their financial situation.

Dealing with economic stress

Dutch Mendenhall was part of a major business during the 2008 GFC. This gave him a first-hand lesson of the impact economic disasters can have on business and markets. He saw investors lose hundreds of thousands in the blink of an eye.

It’s always vital that a business can withstand extreme financial duress, but especially during a global pandemic. RAD has techniques in place that allow its portfolio to thrive during periods of economic uncertainty.

While it’s easy for a company to say this about themselves, their 2020 returns suggest RAD Diversified is true to their word. They managed to post a 36.7% return in 2020, when the pandemic was at its zenith.

Who can invest with RAD Diversified?

What makes RAD’s fund extra-special is that it is open to both accredited and non-accredited investors ????

Ultimately, anyone can invest in RAD Diversified. They have a broad target audience and let anyone with a minimum $1,000 deposit gain exposure to their real estate portfolio.

The main demographics include:

- First-time investors looking to get experience in the real estate market without having to drop a six-figure lump sum.

- Day traders or stock market investors interested in diversifying their portfolio away from typical assets.

- Anyone interested in real estate who doesn’t want to deal with the illiquidity, mortgage repayments and interest rates that buying a property comes with.

RAD Diversified are also SEC qualified, which means that they also frequently work with retirees and their retirement funds. Similar to AltoIRA, they can even help investors set up an IRA fund or 401k with their real estate portfolio.

Given their tax background, RAD Diversified can assist with tax benefits on retirement funds to ensure investors are getting the most out of their assets.

How to invest

To start, investors will need at least $1,000 to purchase shares in RAD Diversified’s REIT. This is a very low minimum.

With these funds, you can buy a proportionate percentage of ownership in their real estate portfolio, the size of which depends on your investment and the portfolio’s NAV. The higher the portfolio’s NAV, the higher the share price.

RAD Diversified have set their current offering at $50 million, and so far, they have raised $20.1 million. The current share price is $16.39, which has grown from the starting price of $10.

Getting started is pretty simple. Visit the site, make sure to read all of the relevant documentation to understand where your money is going.

From there, you will undergo an easy signup process which leads you to the investment dashboard. They have a simple questionnaire powered by Dealmaker, and are using Entoro to broker/manage the Reg A offering. Both are well-known companies in this space.

You can pay via Credit Card, Mastercard, Visa, American Express, Wire transfer, Check, or IRA.

Risks of investing with RAD Diversified

Like with any investment, you can’t just hurdle in head-first and expect to become a millionaire. Caution and due diligence must always be exercised.

While RAD Diversified’s annualized returns are very appealing, there’s an age-old saying that I’m sure has been drummed into your head repeatedly. Let’s go over it, just one more time:

“Past performance is not a reliable indicator of future performance.”

It has been nearly impossible to lose money in real estate over the past 10 years. Experienced investors are split on the topic, but there are rumblings among some that the current housing market is in a bubble.

REITs recovered nicely from the 2008 real estate crash. But the Covid crisis has hammered commercial real estate yields, and owners of office properties could suffer pain for many years to come. The growing popularity of remote working coupled with worse economic prospects will lead to less demand for office space. This comes at a time when the office market already was overbuilt.

Nobody knows exactly what the impact will be, but tenants will certainly have greater bargain power when renegotiating leases and rents are likely to come down in most locations.

If the housing market were to crash (again), the diversified nature of RAD’s property portfolio may allow it to perform better than most. And in the event of a major crash, RAD’s survival project and Tax Deed business would be there to help cushion the blow.

Also, remember equity markets are more volatile than real estate markets, Since RAD’s REIT is not a publicly-traded, their portfolio is able to avoid the wild swings of the stock market.

However, since the REIT is non-traded, it may suffer from liquidity issues. If you want to actively trade your investments, or expect to need money in a pinch, you may want to look elsewhere.

Whatever your financial position, make sure to have a look at the properties RAD Diversified is offering, and compare their returns with the portfolios of other diversified REITs to ensure you’re happy with their investment thesis.

Conclusion

REITs can be a great way for you to gain exposure to the real estate market without having to cough up a massive down payment, or worry about all the little (yet expensive) bits and pieces that add up.

The combination of high dividends and strong passive returns can present an appealing investment opportunity to those bullish about the property market.

RAD Diversified has an experienced founder, and is trusted by a large number of investors. Their REIT has posted some of the best returns out of any publicly available real estate fund, and their “alternative” philosophies are appealing — we love alternatives, after all!

Fractional real estate investment, whether through a REIT or crowdfunding, is continuing to grow in popularity. We’re thankful for companies like RAD Diversified, who continue to offer new and creative ways for investors to get into real estate.