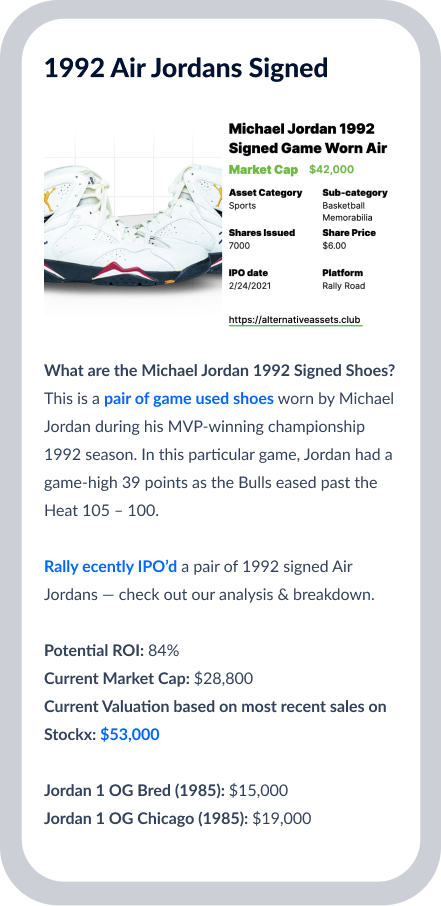

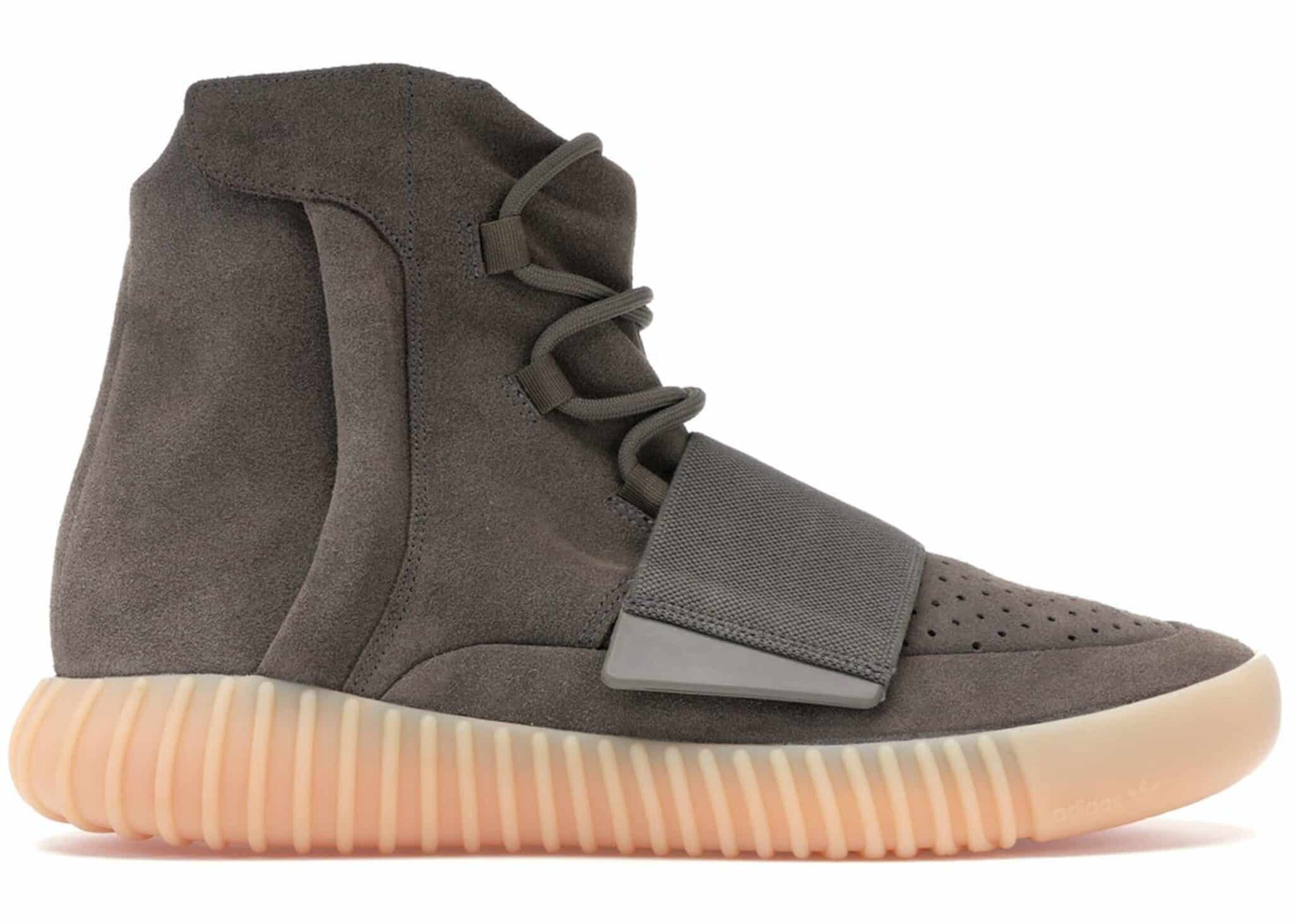

Adidas Yeezy sneakers: The rise, fall, and current state of the market

In this special guest issue, James Platt writes about Yeezy’s rise to glory, the battle against Air Jordans for sneaker supremacy, the fall from grace, and where things stand today.