Home Equity Investing

Home equity investing may be the single biggest story in real estate that almost no one is talking about.

Real estate is one of the most popular and attractive investment opportunities known to man. As one of the first asset classes to be fractionalized, and with new real estate crowdfunding platforms such as Here, Fundrise, CityVest, LEX Markets, and Honeybricks, there is now more opportunity to invest in both commercial & residential real estate than ever before.

We research and write about it from time to time. Follow this asset if you’re interested. We’ll send occasional updates.

Home equity investing may be the single biggest story in real estate that almost no one is talking about.

It’s easy to forget how broad commercial real estate is. There at least four bright spots in the market, and today we’re looking at each one.

Tequila Industry Cash Flow Part 1, Tequila Industry Cash Flow Part 2, STRs in Puerto Vallarta, and More!

A comprehensive recap of our very first alternative investor retreat: A unique tequila-themed journey to the heart of Mexico.

Learn the pros & cons of Regulation A, and how to analyze risk in LROs through a Groundfloor offering

Unlike office buildings, converting hotels to housing is relatively easy to do, and has favorable unit economics for investors — not to mention tax incentives.

We delve into the overlooked economics of parking lots in the US, uncovering how zoning laws and tax policies led to an oversupply of parking. We also explore their investment potential amidst changing urban policies.

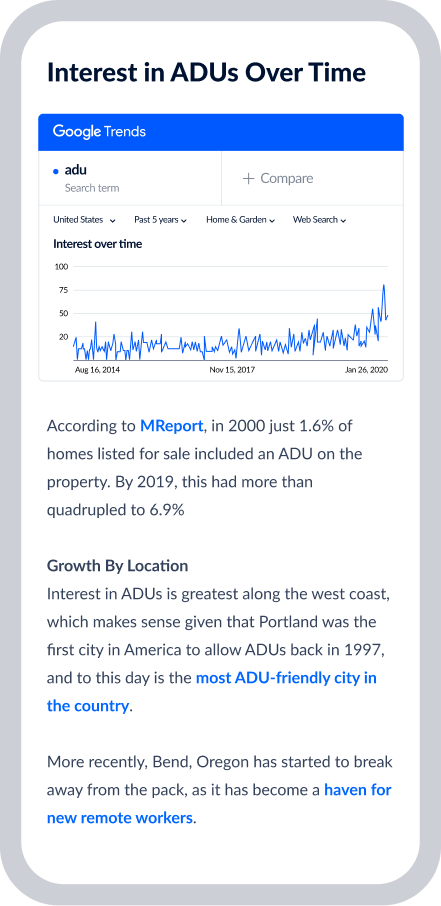

Most of Americans’ wealth is tied up their homes. A niche industry is emerging to help American homeowners understand and tap into their home equity: The Home Equity Management industry.

The market had its best week in three months, The cost to buy a home is now 52% higher than the cost to rent, which is a record, Creator economy and DTC startups are getting smash hammered, and More.

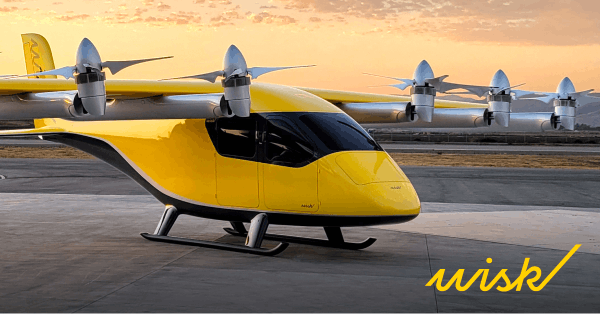

You may not see flying cars in the sky yet, but a lot is happening on the ground. eVTOLs are the closest thing we have. Capital is pouring into the space, but regulation is still lacking.

Tough week for macro-watchers, Mortgage rates approach 8%, Trucking companies are going bankrupt, The move toward private credit continues apace and More.

1031 exchanges are one of the most popular, lucrative, and (arguably) unfair real estate tax loopholes in the world. Here’s how they work.

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |