This is the FREE version of our Game Trading Cards Insider. We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

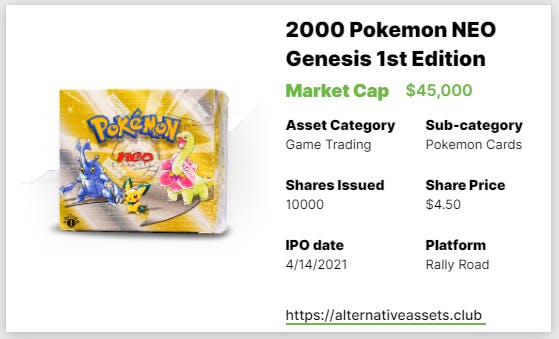

Today I’ve done a deep dive into the 2000 Pokemon 1st Edition Neo Genesis Booster Box that will IPO at Rally Road on April, 14th, 2021 at noon EST.

Follow me on Twitter for my latest insights and analysis.

Table of Contents

What is the 2000 Pokemon 1st Edition Neo Genesis Booster Box?

This is a sealed, Pokemon 1st Edition Neo Genesis Booster Box, originally released in 2000. It was the eighth expansion for the Pokemon trading card game (TCG) and includes 36 packs of 11 cards each. Be aware when doing your own research that, as for many of the sets, there is a 1st edition Neo Genesis set and an unlimited Neo Genesis set with the former being considerably more valuable.

The complete set is 111 cards with 19 rare holo variants, including by far the most valuable card in the set, the Lugia #9, which I wrote about here. It is also believed, but not confirmed, that the production run for the Neo Genesis 1st edition was much lower than prior expansions, making sealed boxes rarer.

Rally bought their box on January 27th for $40,133.

It IPOs on Rally Road at 12 PM EST on Wednesday, April 14th for $45,000.

Add IPO to calendar

Cultural Relevance

I’ve talked at length about the popularity of Pokemon, and it ranks very highly in all our social media metrics, but what’s important here is the popularity of the Neo Genesis Set. As mentioned above, it was the eighth expansion, but it was the first to feature the second generation of Pokemon so it does carry a little more cachet than its release order would indicate. The boxes tend to sell for twice that of any of the other expansions (including the Rocket and Gym Heroes boxes I’ve written about, and the Fossil and Jungle boxes that Rally has previously IPO’d), largely because of the Lugia card.

Inferred Value – $30K+

[Detailed Valuation available to Insiders Only]

Category Strength

The Game Trading cards subcategory returned -1% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Asset Growth TTM

Growth Outlook and Future Catalysts

The value of the box is really tied to that Lugia card, and as I wrote about there, there’s nothing specific on the horizon, but any movie or TV appearance would boost awareness. Luckily, there is a box up for Auction at Heritage in July that will coincide very well with the expiration of the 90 day lockup period, so when this asset goes for trading we’ll have a very good idea of what the market value will be at that time.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade quarterly.

Platform Risk

Intangibles

People like sealed boxes and the air of mystery. It’s like a Christmas present. But Rally has been IPO’ing a lot of these recently and at some point fatigue is going to set in.

Share Alternative Assets, Get Rewards

Enjoying Alternative Assets? Now you can share your personal referral link and get rewarded.

Get hoodies, tees, and other cool swag. When someone signs up through your link, your referral count goes up.

It’s a generous program. Rewards start at just 2 referrals!

- Your referral count: {{subscriber.rh_totref}}

It’s easy. Click the button below to access your rewards hub:Go to my Rewards Hub →

Or copy & paste your referral link here: {{subscriber.rh_reflink}}

Share on Twitter | Share on Facebook | Share via email

Thanks for spreading the word!

Start a free trial of Insider

Deep research and unparalleled insights, now on thirteen alternative investment classes.

Unlimited insight for less than $9 per week.

Start your Insider trial today.